by SouthLaGeo

The post that follows is a guest post by SouthLaGeo, a geologist with over 30 years of oil industry experience.

![SouthLageo/]()

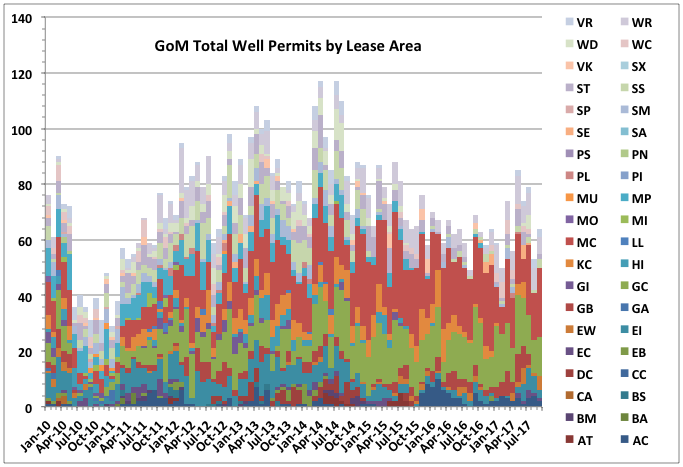

In this post, I will address 3 topics relating to the Northern Deepwater Gulf of Mexico –

1. Historical oil production

2. One view of the future of exploration

3. EUR ranges

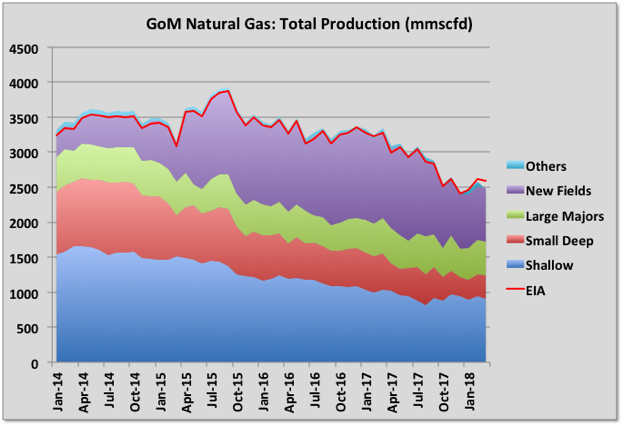

I will limit my comments to oil production (not gas production). All production data is from BSEE/BOEM. The play outlines on the map are my best estimates. I will be using the BSEE definition of deepwater which includes water depths greater than 1000’. And, I will be assuming a Business As Usual future – by that I mean that fossil fuels will continue to be an important an energy source, and the world will continue to be able to afford them.

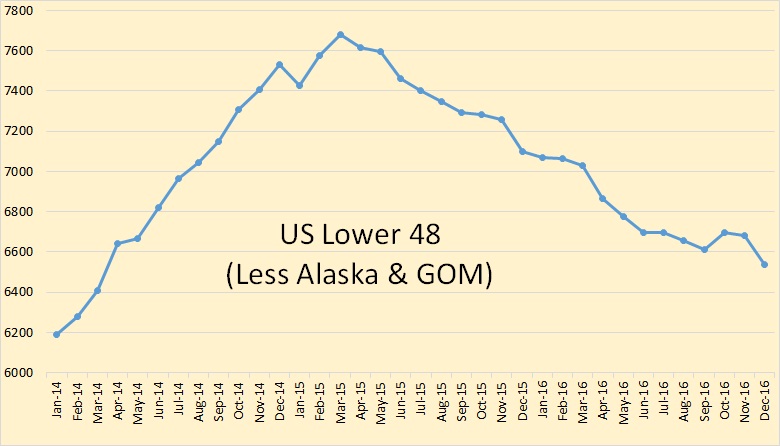

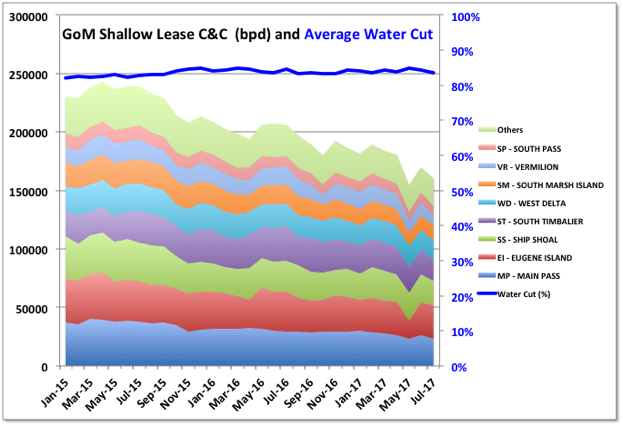

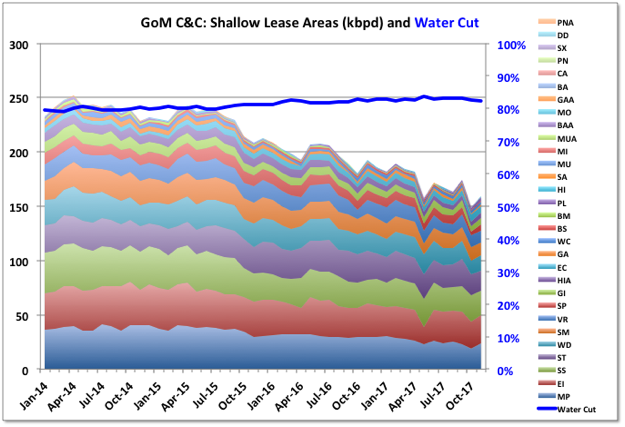

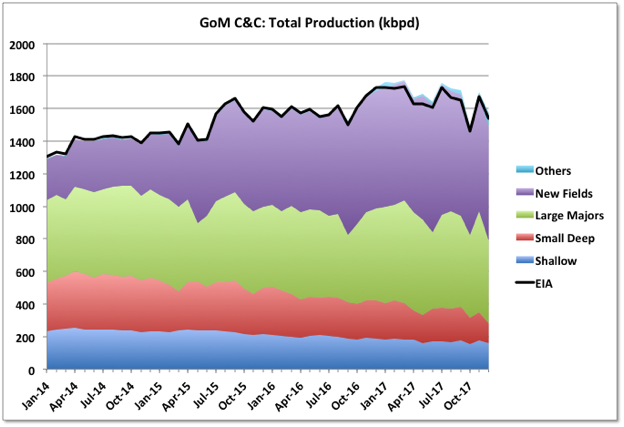

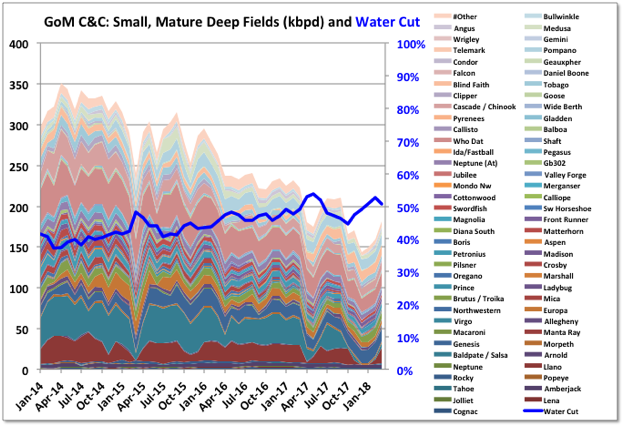

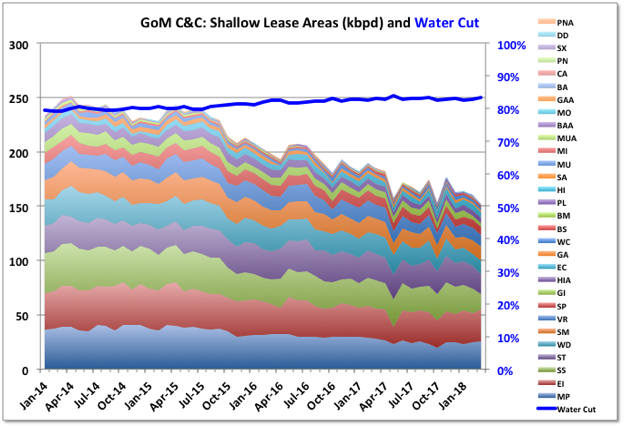

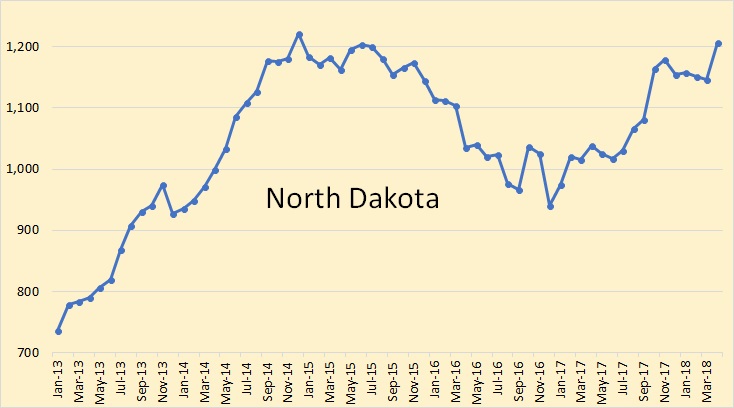

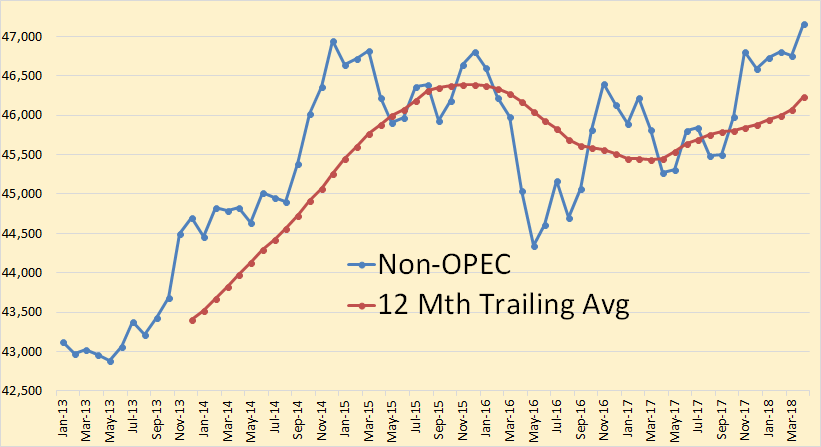

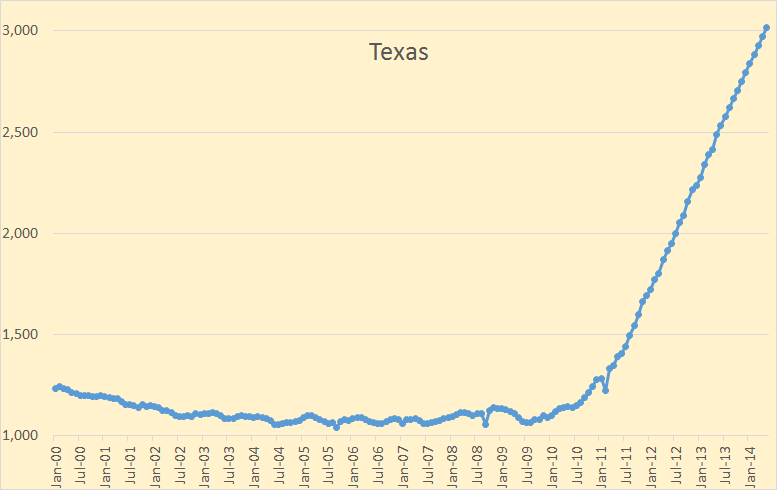

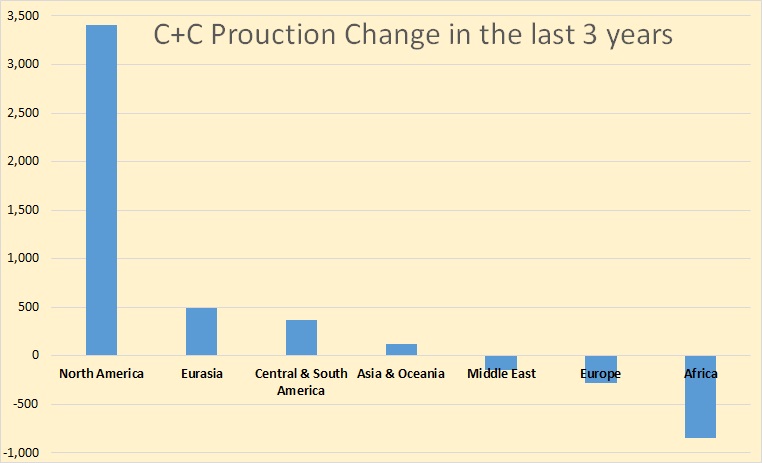

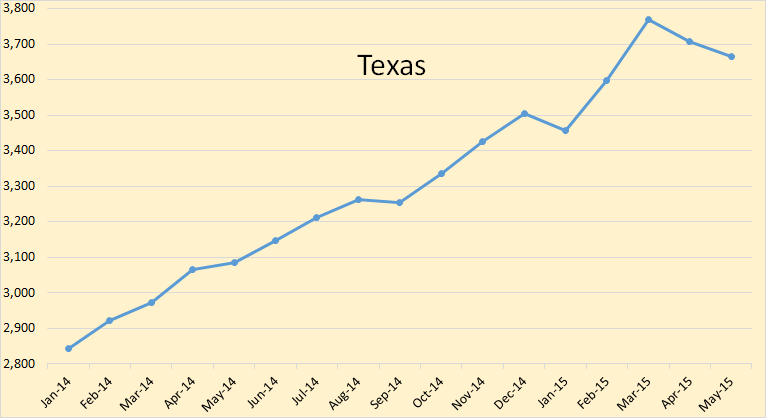

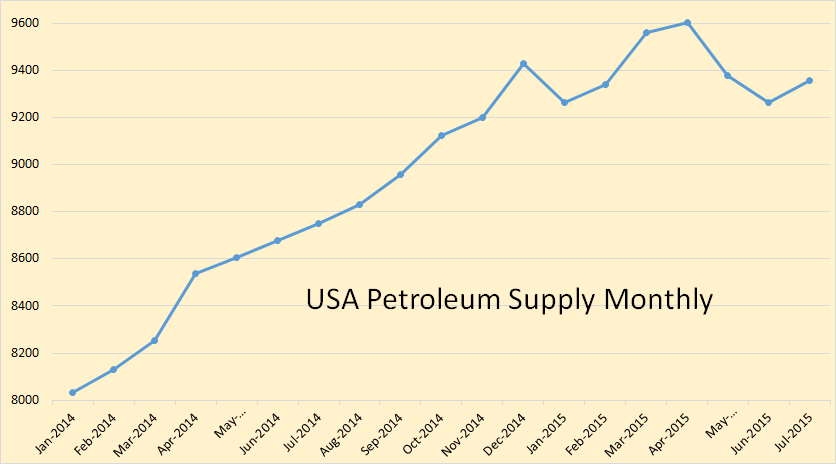

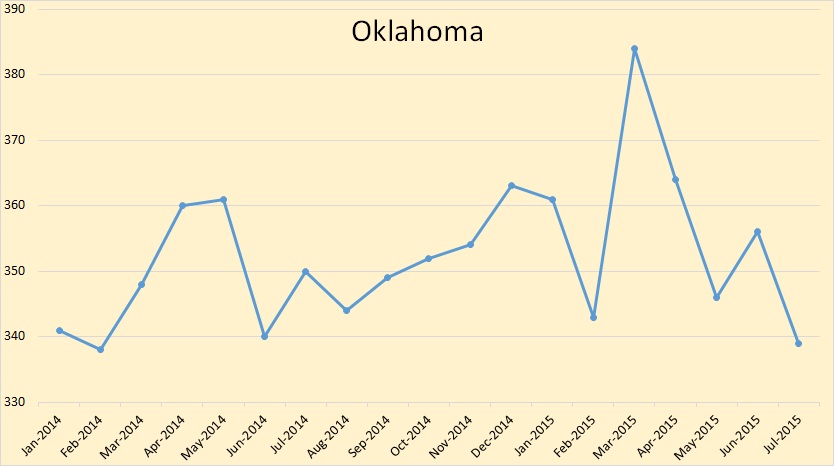

1. Historical production

Cumulative production to date from the deepwater GOM is about 7 billion barrels of oil (Bbo). Total shelf production is about 13 Bbo. The chart below shows both shelf (in green) and deepwater production (in brown/red), in annual, increments, going back to 1985. As you can see, shelf production dominated throughout the 80s and 90s, and then in 2000 deepwater production exceeded shelf production, and it has been that way ever since. (The totals above include production from before 1985)

![SouthLageo/]()

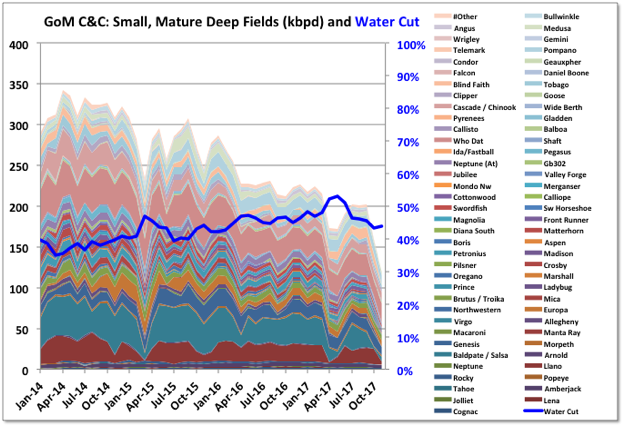

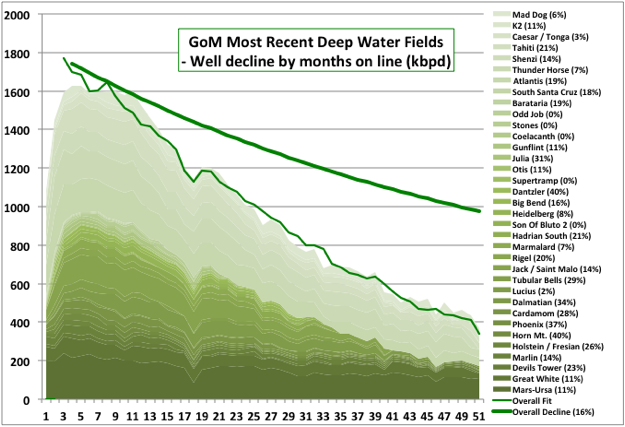

The 3 peaks in deepwater production, in 2002-2004, 2009-2010, and the present peak from 2014, are the results of advances in technologies that have allowed industry to march into deeper water and produce from deeper reservoirs.

The earliest peak was, in a sense, an extension of shelf play types into deepwater. The reservoirs were Pleistocene to Miocene in age, mostly bright-spot associated, and outboard of salt, and ranged in depth from ~10,000-20,000’. The biggest fields in this trend were Shell’s Mars/Ursa complex in Mississippi Canyon, and their Auger field in Garden Banks. Peak production approached 1 million barrels of oil per day (mmbopd).

What is a “bright spot”? Without getting into geophysics too deeply, a bright spot is an anomaly that stands out on seismic data relative to the background, and is often an indicator of an oil or gas accumulation. Google it and you will find some nice examples.

As technology advanced, industry moved in to deeper water and deeper reservoirs. One technology in particular, seismic acquisition and processing, was critical in this regard. The next trend, the subsalt trend, was discovered because of advances in seismic technology.

The Seismic Advantage:

The use of seismic data has always been an important tool for explorationists to identify oil and gas prospects (e.g. the application of bright spot technology to identify oil and gas reservoirs outboard of salt as mentioned above), and this is even more so the case in deepwater where exploration wells are expensive, but seismic data is relatively cheap.

Much of the deepwater Gulf of Mexico is underlain by an allocthonous salt canopy (allocthonous = “out-of-place”, meaning in the salt is currently not in the position within the stratigraphic column where it was deposited. Actually, much of the entire northern Gulf is underlain by allocthonous salt, but, on the shelf and “shallow” deepwater, all of the oil and gas reservoirs are above the allocthonous salt. See stylized cross section below.)

So what’s the big deal that much of the deepwater is underlain by a salt canopy? Well, because of the large acoustic impedance contrast between salt and surrounding sediments, salt severely distorts seismic energy with the result being that it is very difficult to get a good image of the geology below the salt, and it is in these subsalt sediments where the oil and gas may be. The cartoon cross section below illustrates this. With “old seismic data” say pre-1995 or so, the seismic image of a given area in the deepwater would look like the image on the left. You could see down to top of salt, but then had no idea what was going on below that salt. But, as seismic technologies advanced in the 1990s, we could start to see images like those on the right – we could image not only the base of salt, but also potential subsalt seismic events that could create hydrocarbon traps. The cartoon on the right is actually a reasonable representation of Chevron’s Tahiti field in Green Canyon.

![SouthLageo/]()

The stylized regional cross section below, edited from a cross section originally published by McMoran, shows the geometry of the salt canopy, and how the canopy separates above salt, or supra-salt, basins from subsalt basins. The length of this cross section is about 300 miles. The deepwater subsalt discoveries I’ll be discussing are located in the Middle and Lower Miocene, and Eocene (~Wilcox) formations.

![SouthLageo/]()

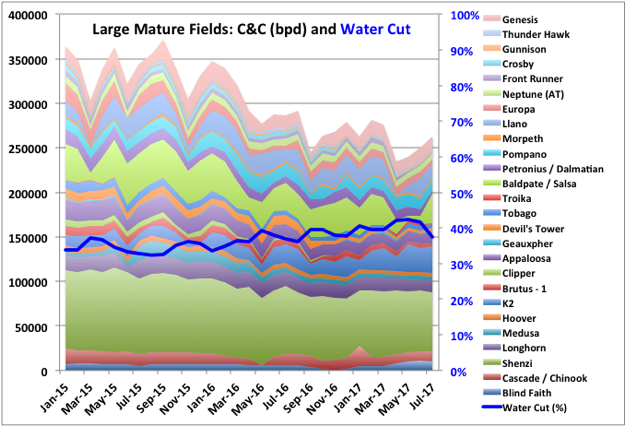

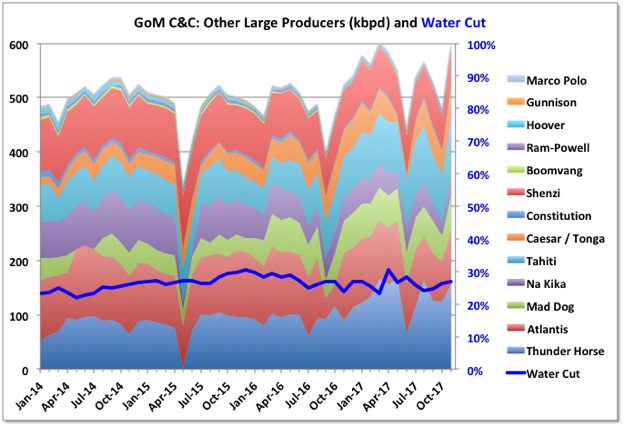

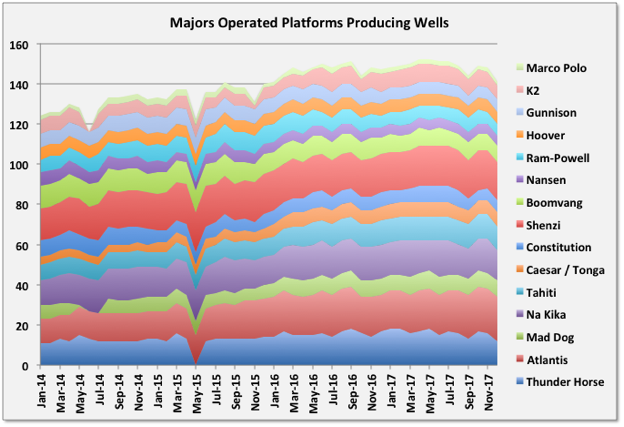

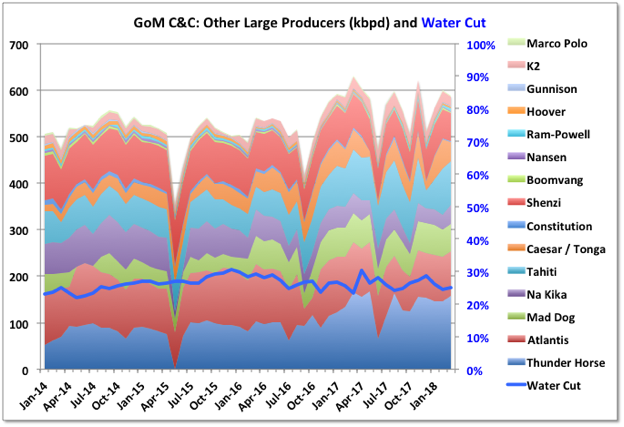

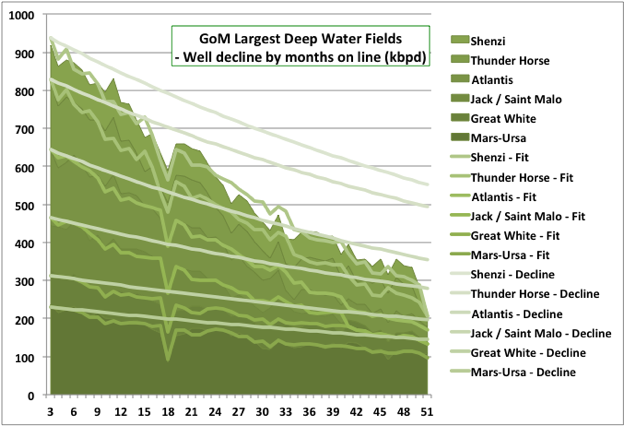

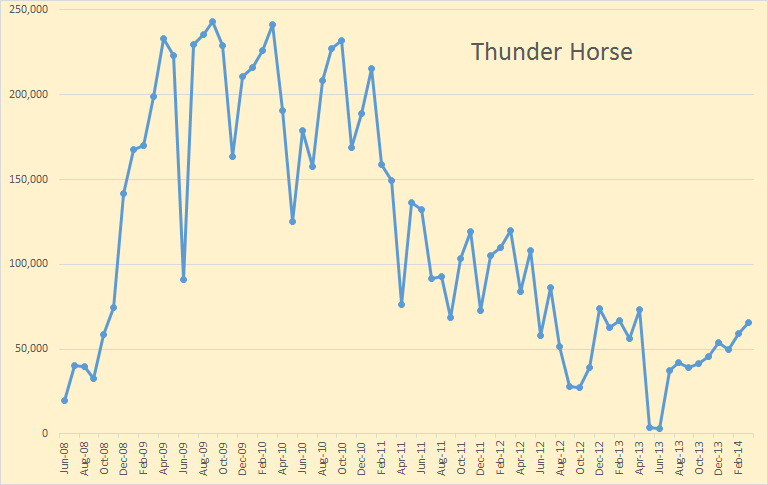

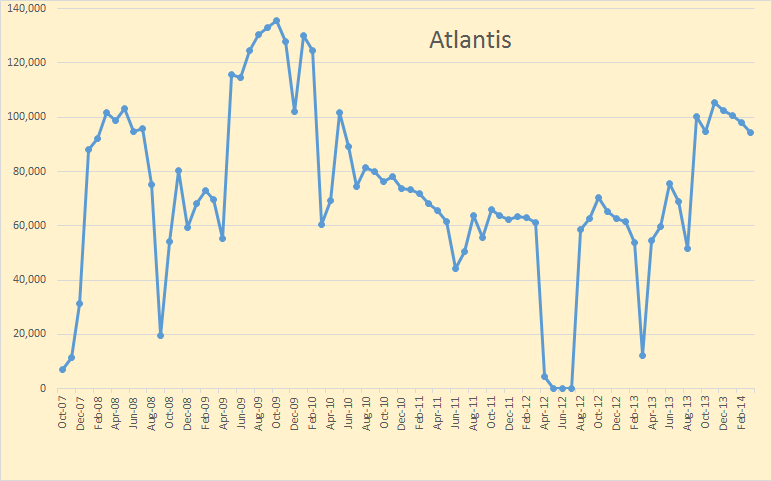

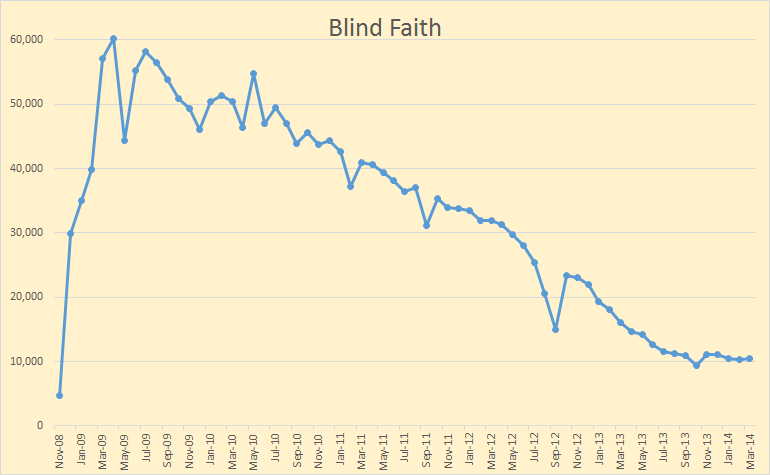

With the advances in seismic technology, and many other technologies as well (drilling, completions, platform fabrication, risers, subsea infrastructure, etc,) industry advanced into deeper water, and was particularly sucessful in finding large oil accumulations in southeast Green Canyon. The next peak in deepwater production came in the 2009-2010 time frame as a number of these fields came on production, especially Tahiti, Atlantis and Shenzi from the southeast Green Canyon trend, and Thunderhorse from Mississippi Canyon (Thunderhorse is just east of Mars/Ursa on the map below.) The initial production from these fields resulted in the biggest year-to-year increase in oil production ever in the deepwater – approximately a 400 kbopd increase between 2008 and 2009. Durings this peak, deepwater production was at record levels of about 1.25 mmbopd.

Unfortunately, many of these fields experienced rapid early production declines, and that, in addition to an overall reduction of deepwater drilling in late 2010 and 2011 as a result of the Macondo drilling moratorium, led to the rapid production declines.

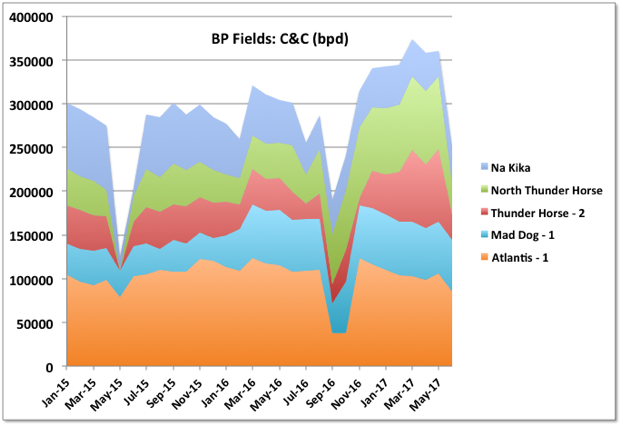

Much has been written over the years in both this forum and TOD about this rapid production decline, particularly in reference to BP’s Thunderhorse field. It would appear to me that Thunderhorse has certainly been a disappointment to BP, but they have continued to develop the field, and have recently instituted a waterflood. The other fields I mentioned above, all from the subsalt Miocene trend in southeast Green Canyon, have been more successful.

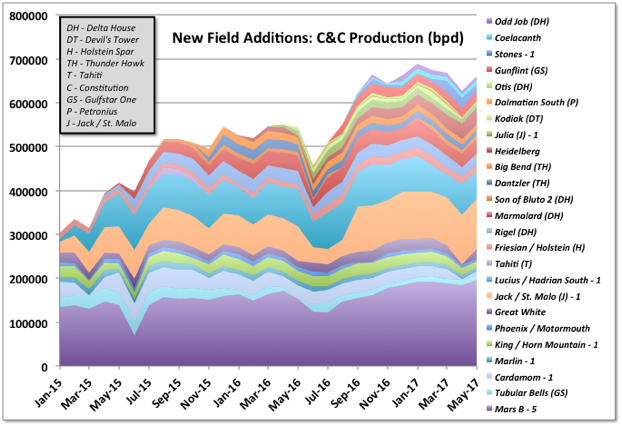

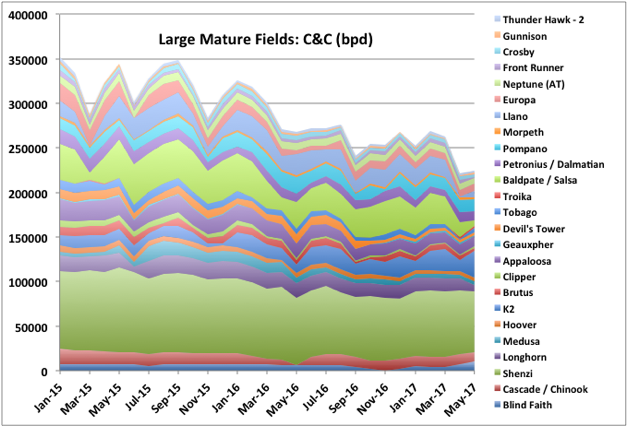

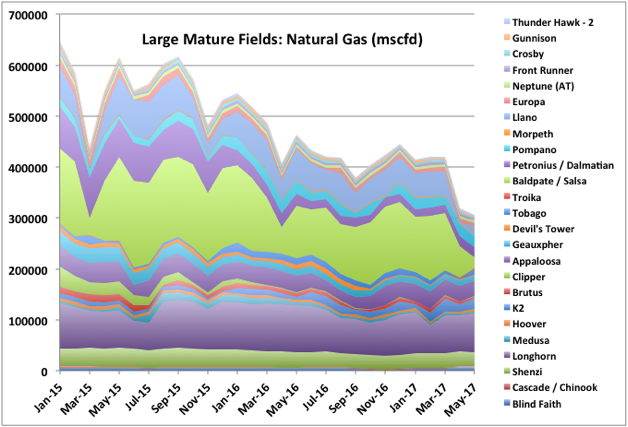

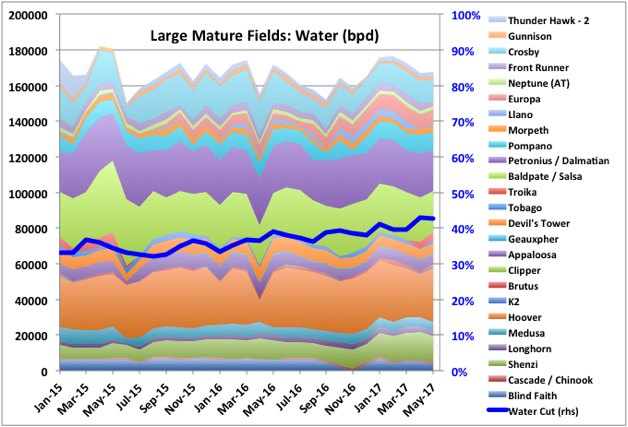

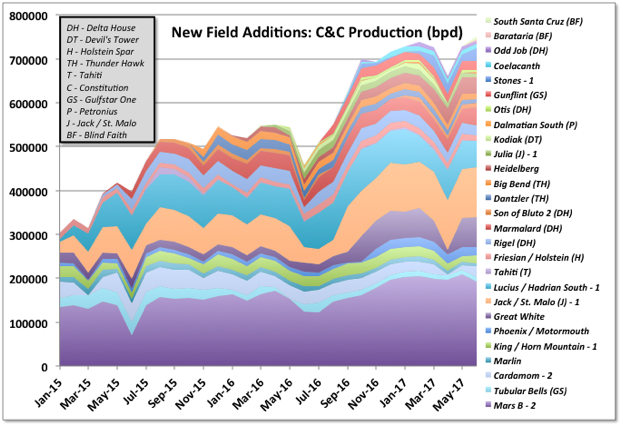

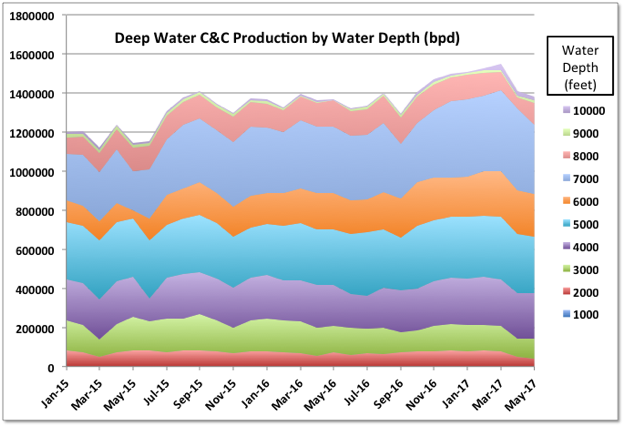

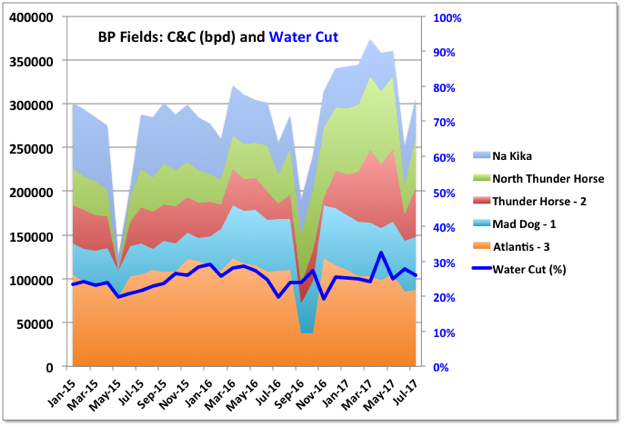

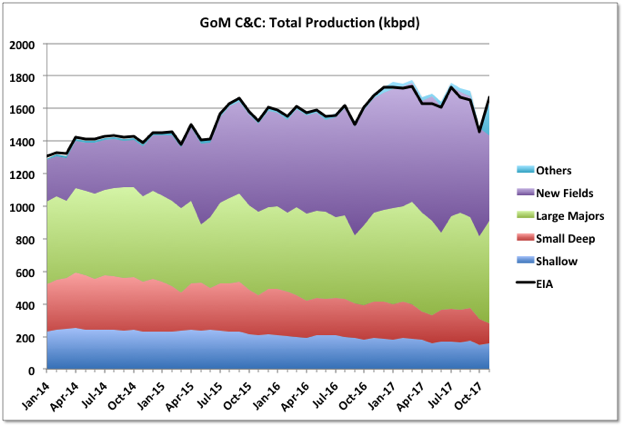

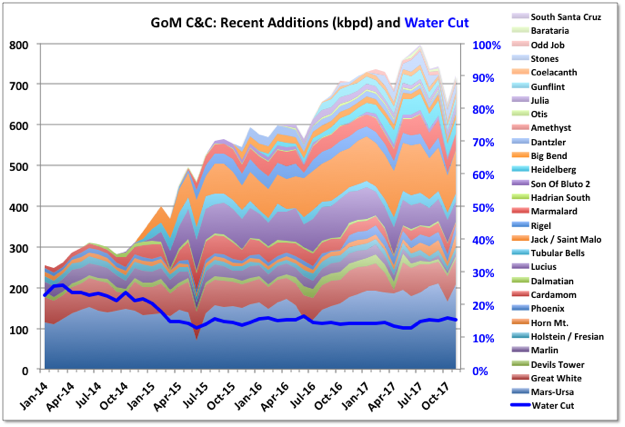

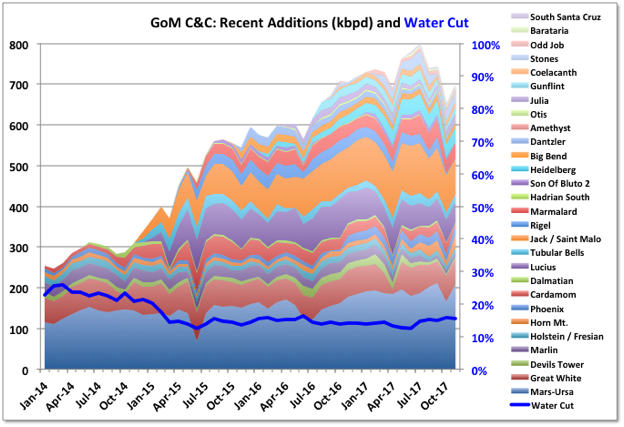

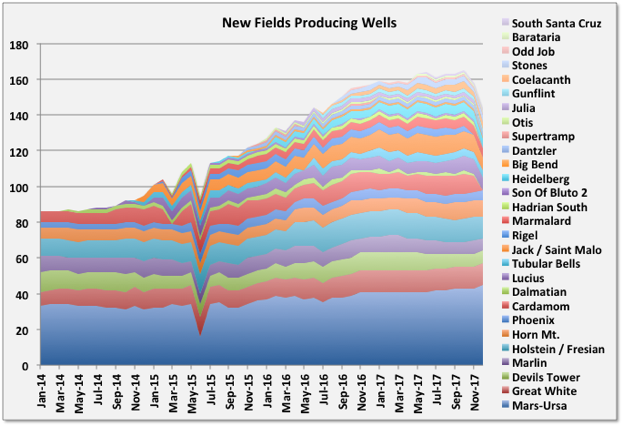

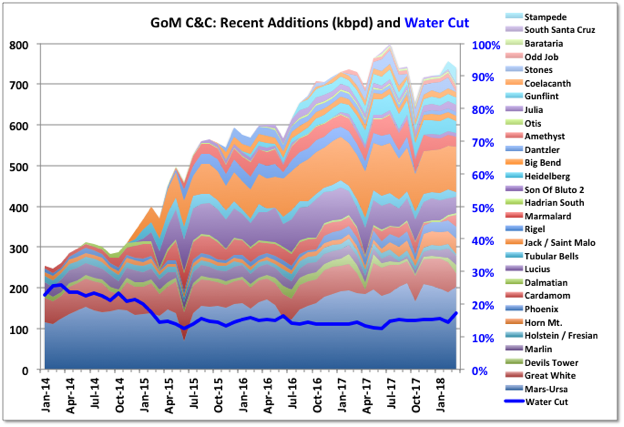

We are currently seeing a 3rd peak starting in 2014. While the chart above only goes through 2015, early 2016 data indicates that overall production is approaching record levels, and if one backs out shelf production, it is almost a certainty that we are currently seeing record deepwater production levels of over 1.3 mmbopd. The major factors contributing to this are :

- Redevelopments of a number of existing fields including Mars, Atlantis, and Auger (The successful redevelopment of Atlantis resulted in it being the most prolific oil field in the GOM in 2015 averaging over 100 kbopd)

- Initial production from Wilcox fields such as Great White and Jack/St.Malo

Over 30 years of production have demonstrated that there are definite sweet spots within the deepwater Gulf- most notably, the subsalt Miocene of Southeast Green Canyon, and the greater Mars/Ursa basin (see trend map below). Both of these areas have prodcued over 1 BbO, and both have a lot of future prospectivity and are likely to achieve at least 2 BbO or more in ultimate recovery. Five of the six biggest fields to date are from these trends.

Top 6 Northern GOM Deepwater fields in terms of cumulative oil production:

![SouthLageo/]()

![SouthLageo/]()

2. One view of the future of exploration

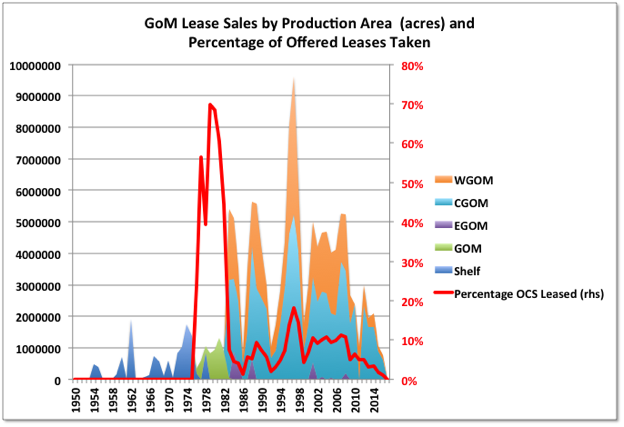

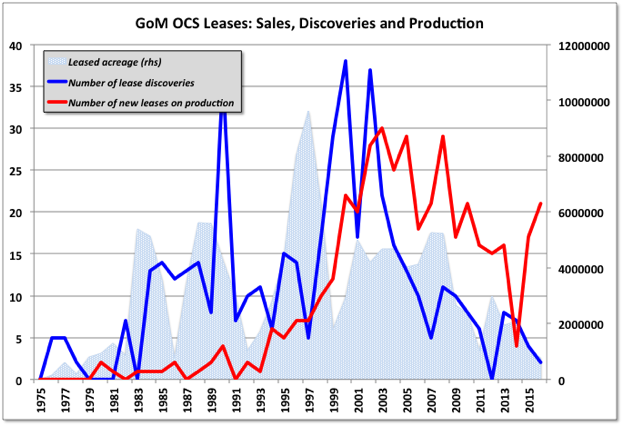

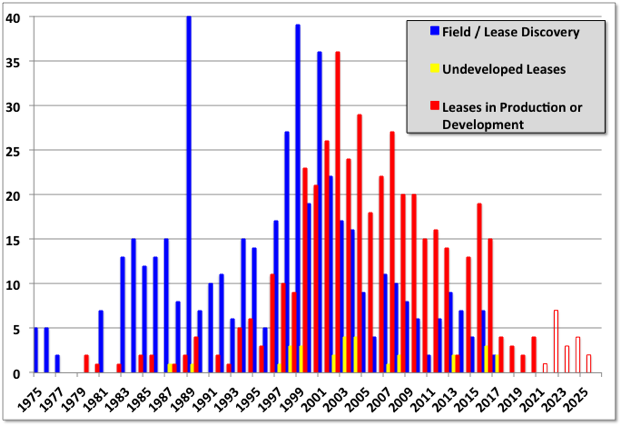

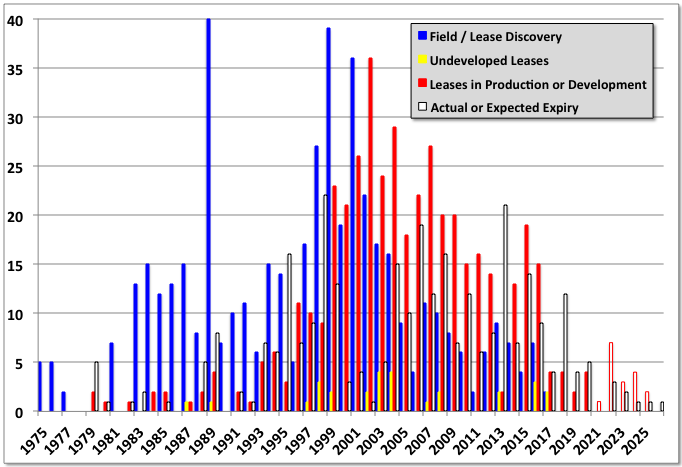

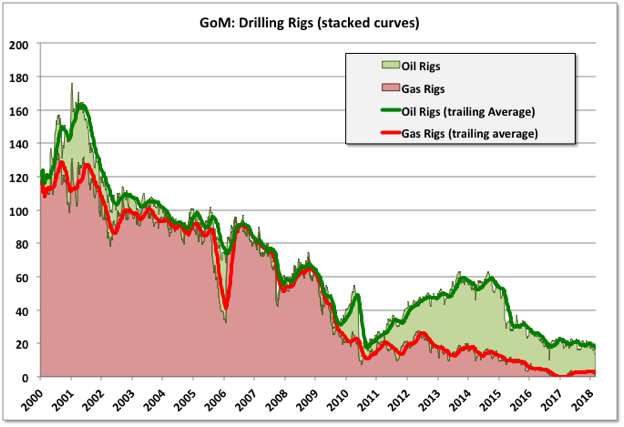

Over the last few years, the exploration results for industry in the deepwater Gulf of Mexico have been disappointing. In my opinion, 2 factors contribute to this –

- Low oil prices have reduced exploration drilling

- The deepwater Gulf is becoming a fairly mature province

Item # 1 above is hard to debate. Overall deepwater drilling is down, and along with that, exploration drilling is down.

Item #2 above might be debated, but let me explain my reasoning.

15-20 years ago, some prognosticators called the Gulf of Mexico the “Dead Sea” because, in their view, there were no more unexplored areas. (Remember, at that time, virtually all of the production was outboard of salt, and bright-spot associated.) The view was that all of the discoveries of note had been made and all that was left was to produce the existing fields. But just about that time the revolutionary advances in seismic imaging technology mentioned earlier started revealing prospectivity below the extensive shallow salt bodies in many areas of the deep gulf where before, these areas were just viewed as nonprospective. The large subsalt Miocene discoveries of southeast Green Canyon were made and started coming on line, and then, industry ventured into other subsalt provinces discovering the Wilcox trend. These were the years of the “great unveiling”, as more and more salt bodies were properly imaged and found not to be salt massifs that extended to basement, but were salt canopies with prospective subsalt section below.

Consequently, many discoveries were made including subsalt Miocene fields like Thunderhorse and Thunderhorse North, Mad Dog, K2, Atlantis, Tahiti, Shenzi, Heidelberg, Stampede and Big Foot, and Wilcox discoveries like Jack/St.Malo, Shenandoah, Tiber, Guadalupe, Anchor, Leon, Stones, and many more.

In my opinion, the era of the “great unveiling” is past its peak, and in decline. The areas that remain to be “unveiled” are those where the salt tectonics are often very complex and where prospective section is revealed, it may be below 30,000’, and sometimes even below 35000’.

This isn’t to say discoveries won’t be made. There will continue to be small basin play discoveries– in the 20-40 mmbo range. The edges of the Inner and Outer Wilcox trends may be expanded a bit resulting in a few 100-200 mmbo discoveries. There also may be some, what I call, one-off discoveries – discoveries that appear to be one of a kind and are not indicative of a new trend (Noble’s recent 40-50 mmbo Katmai discovery in Green Canyon, I think, falls into that category).

Is there a legitimate new play/trend yet to be discovered? For example, is there prospectivity in some formation deeper than the Wilcox, such as the Cretaceous Tuscaloosa? While I’m sure industry is looking into this, they have to realize they would be dealing with reservoirs that would probably have even lower porosity and permeability that the Wilcox, and while industry may be starting to figure out how to produce the Wilcox, the Wilcox reservoirs are very thick, and what they lack in permeability, they can make up in thickness. Note McMoran’s lack of success in establishing production from their deep shelf gas discovery, Davy Jones. We will have to wait and see if industry is able to establish production from deep Tuscaloosa oil – assuming, of course, commercial quantities of Tuscaloosa oil are even discovered.

Some also think there may be a presalt play in the Gulf of Mexico, similar to the successful presalt plays in offshore Angola and Brazil. This is, as far as I know, a completely untested play in the Gulf of Mexico, and, consequently, quite high risk.

(Presalt is not the same as subsalt. The subsalt, as mentioned earlier, is the stratigraphy between the allocthonous, or out-of-place, salt canopy and the autochthonous, or in-place, Jurassic Louann salt. The presalt is that stratigraphy below, or older than, the Louann salt. Note that the Louann salt is not identified on the cross section above. If it were, it would be, for all practical purposes, right above what is labeled Mesozoic.)

One big difference industry will find between the Wilcox and any deeper prospective section is that while the deepwater Wilcox sands are thick, fairly continuous, and present over very large areas of the deepwater (see the trend map above and note the size of the Inner and Outer Wilcox trends, and note that well developed Wilcox sands have been penetrated outside the trends, but commercial oil accumulations have not been discovered, with the exception of the Perdido Fold Belt), other prospective sections will probably be much more localized, possibly more channelized, and also thinner. Consequently, the prospective play outlines will be much smaller. The outline of the Norphlet on the play map above is a good example. (The Norphlet is older than the Wilcox, being Upper Jurassic in age and was deposited immediately on top of the Louann salt. The Wilcox is younger, being Eocene/Paleocene).

Some observers point out how the Gulf of Mexico has continued to re-invent itself over the years. When shelf production started declining off its peak in the late 80s (see initial production chart), some thought that was the end for the Gulf of Mexico. But then, production from the shallow plays of the deepwater started to kick-in (Note that shelf production rebounded at this time also. The peak in shelf production seen in the late 90s was largely due to the introduction of 3D seismic to revitalize shelf fields). Then, as mentioned earlier, when the next decline in production occurred, people started writing off the GOM again as the “Dead Sea”, but then production from the subsalt discoveries, first Miocene fields, and now Wilcox fields, started contributing.

Is there another “reinvention” of the Gulf to be made? Or, when this current peak in production begins to flatten out, will that be the start of terminal decline? Let’s see what the state of GOM exploration is by about 2020? If a legitimate new play has been found by 2020, then I can envision another peak in production (or at least a flattening in the rate of decline) in the late 2020s to early 2030s. If not, then it may be that the current peak will be the final peak.

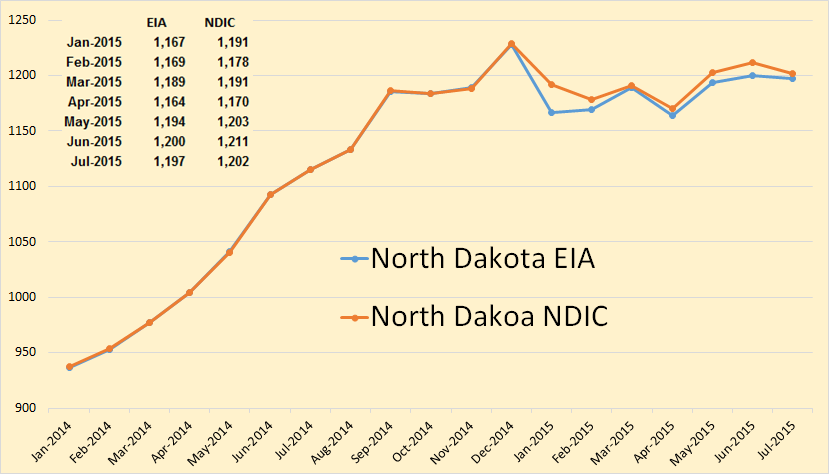

3. EUR ranges

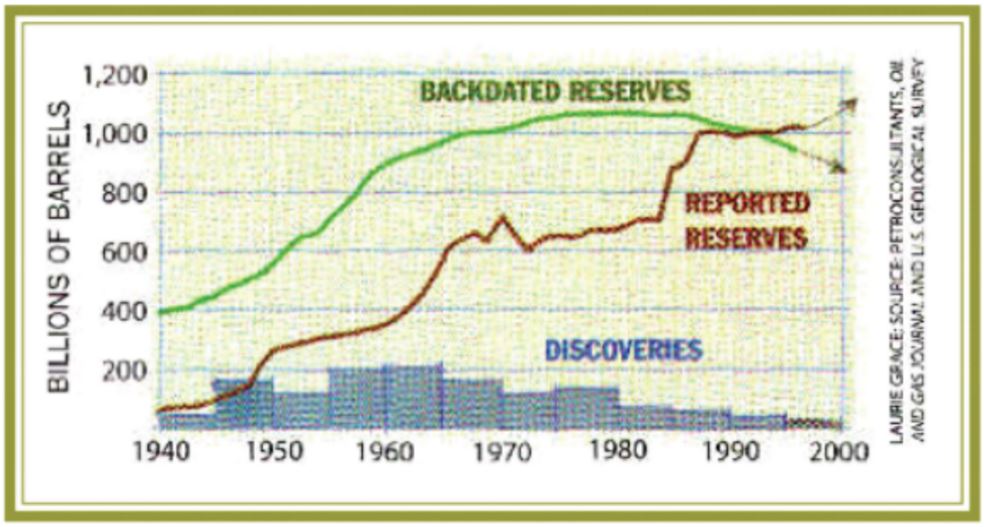

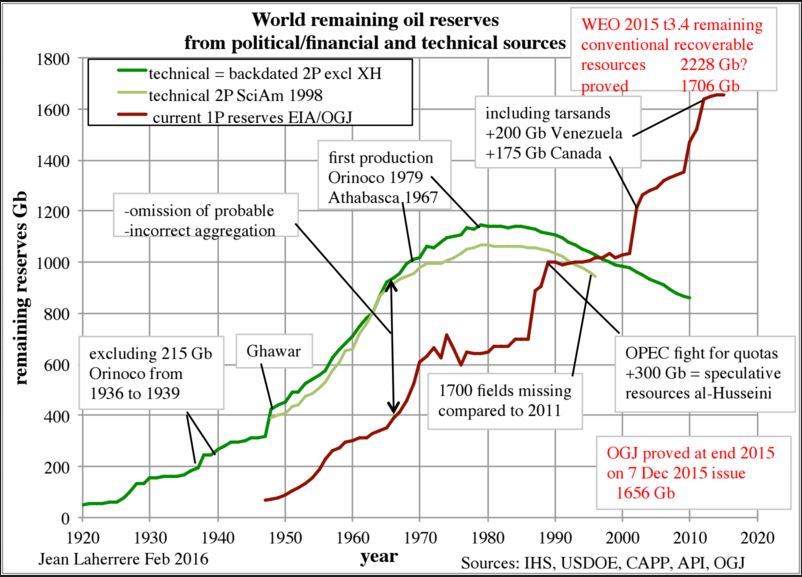

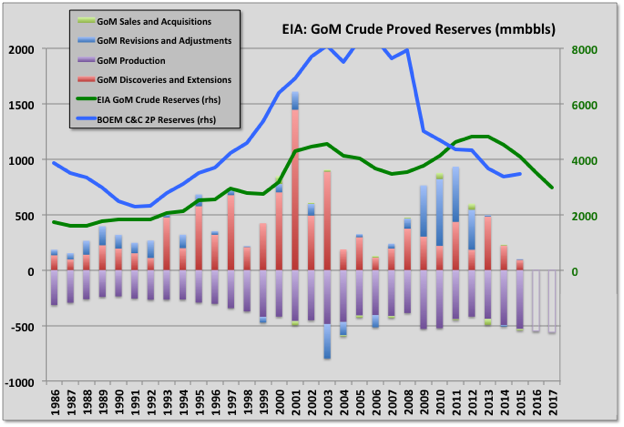

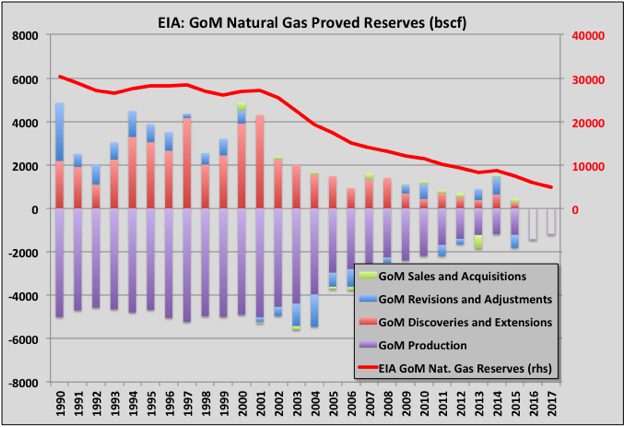

In this section I will present multiple views on Estimated Ultimate Recovery (EUR) ranges for the Northern Deepwater Gulf of Mexico. I will present Jean Laherrere’s recent estimate, comment on recent resource estimates by BOEM (the Bureau of Ocean Management), and then provide my EUR estimates.

(I came across Jean Laherrere’s document called JL_2016USoilultimate.pdf, where I pulled some displays, it is at the following link:

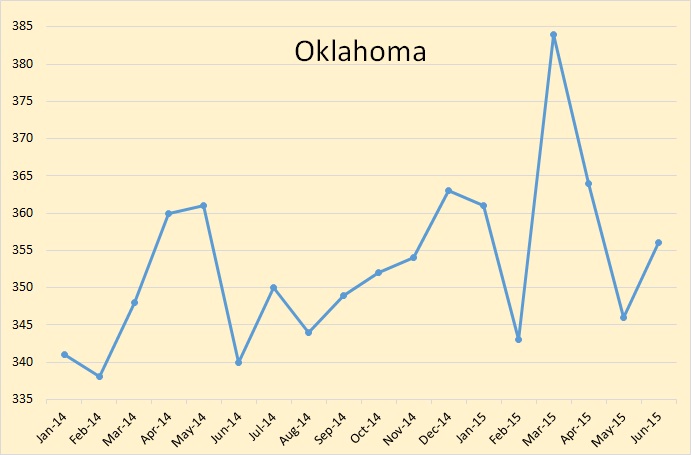

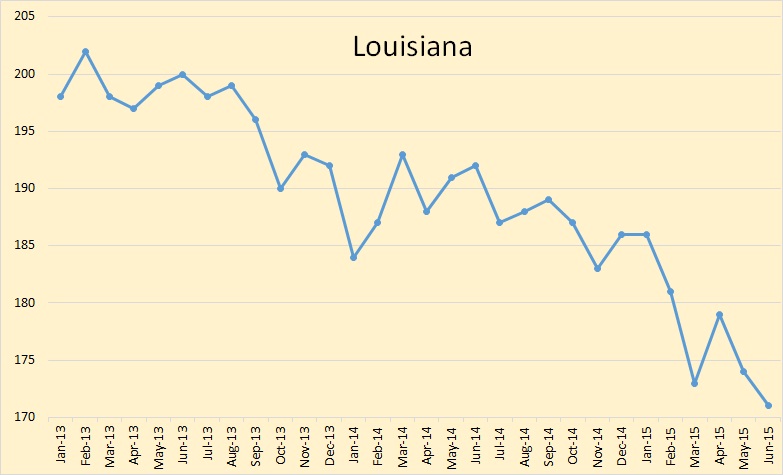

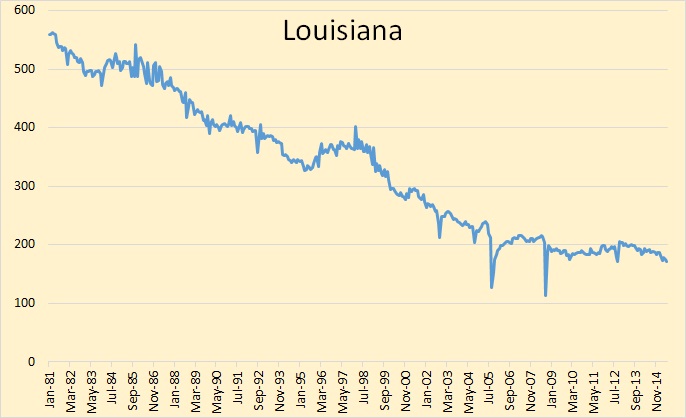

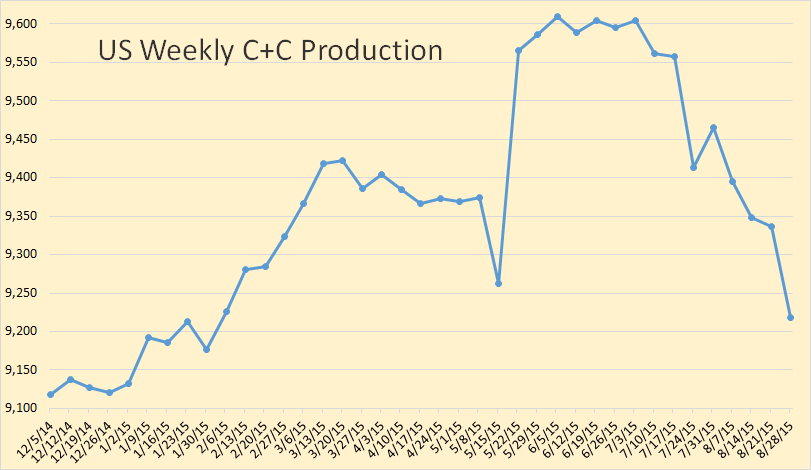

http://aspofrance.org/files/JL_2016USoilultimate.pdf )

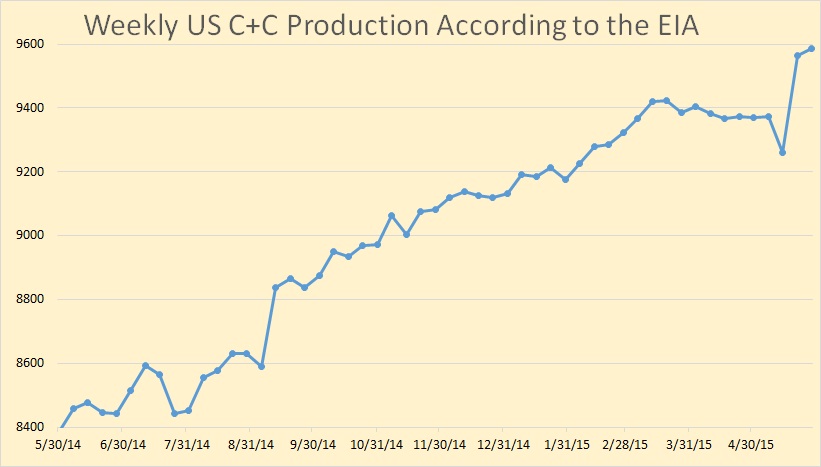

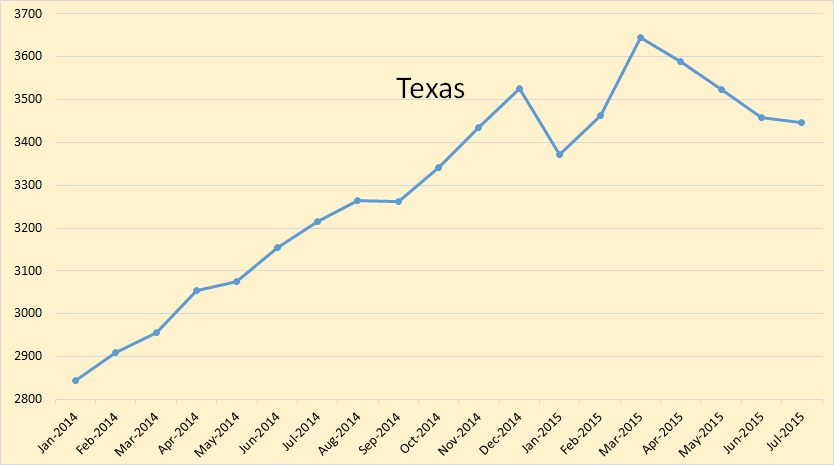

First I will discuss shelf oil production. The chart below is from the 2016 Laherrere presentation where, through the Hubbert Linearization graphing technique (HL), he makes the case for a shelf EUR of around 14 Bbo (Gb). This is, in my opinion, spot on. Current daily shelf production is probably below 200 kbo, activity levels are low, and discoveries are infrequent and small. Even if we had a rapid increase in oil prices and associated shallow water activity, I can’t see EUR getting much higher than 14 BBO, maybe 15 or 16 on the highside.

![SouthLageo/]()

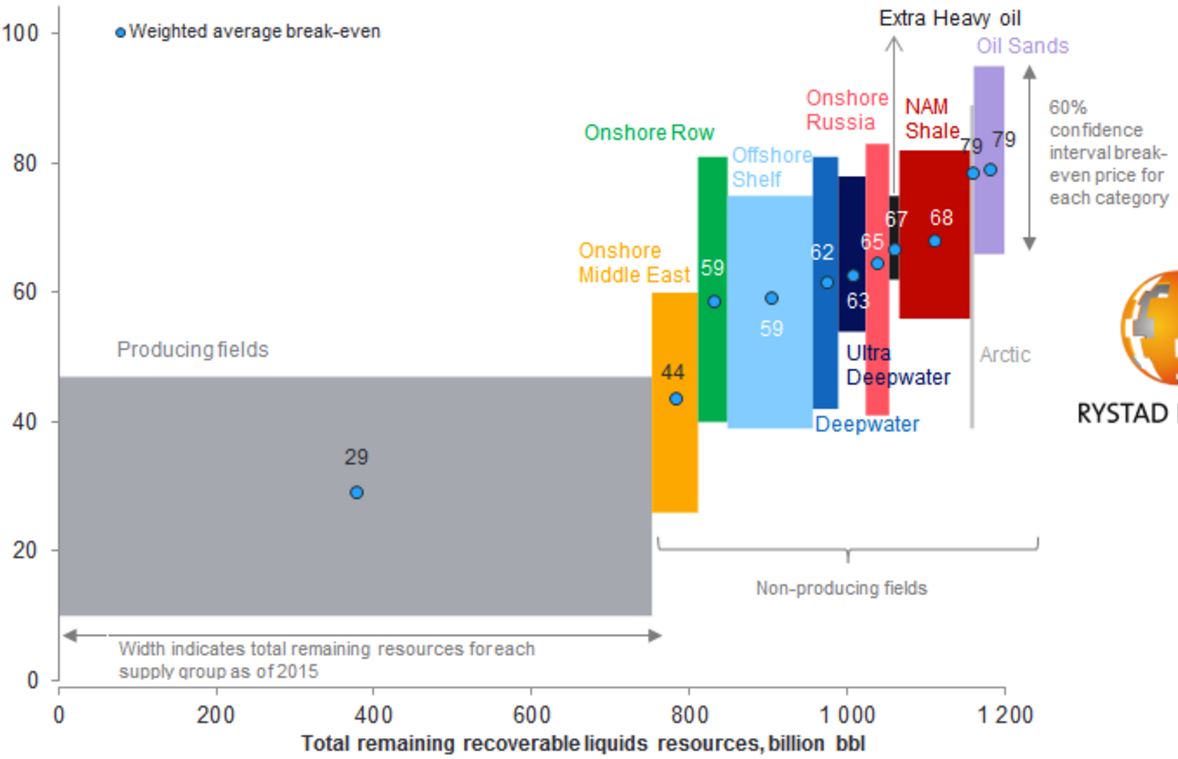

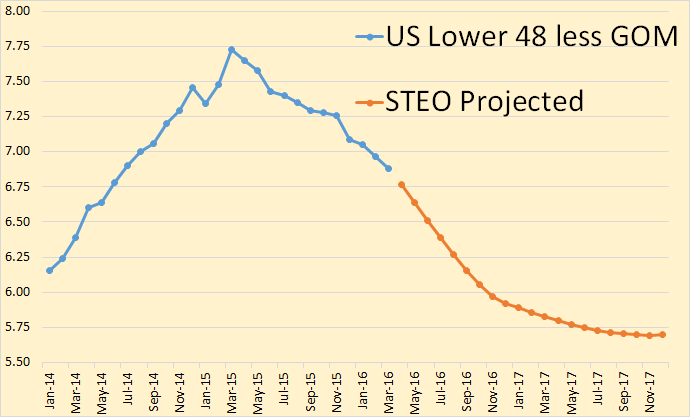

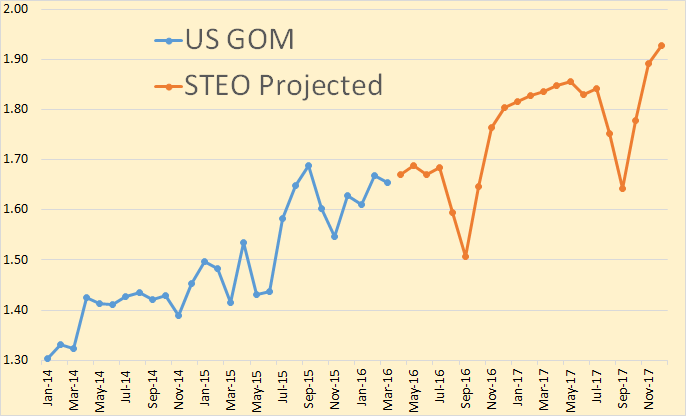

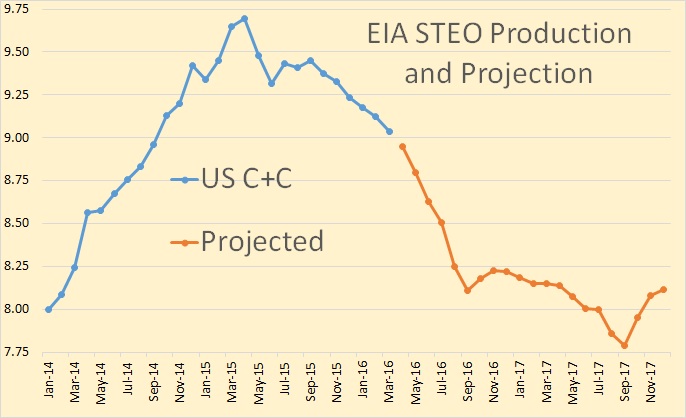

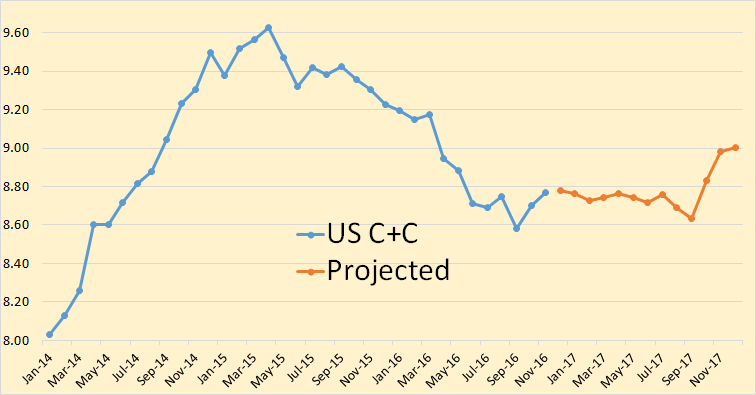

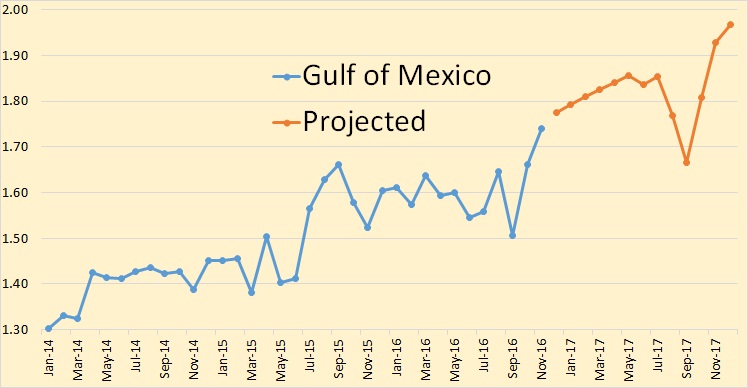

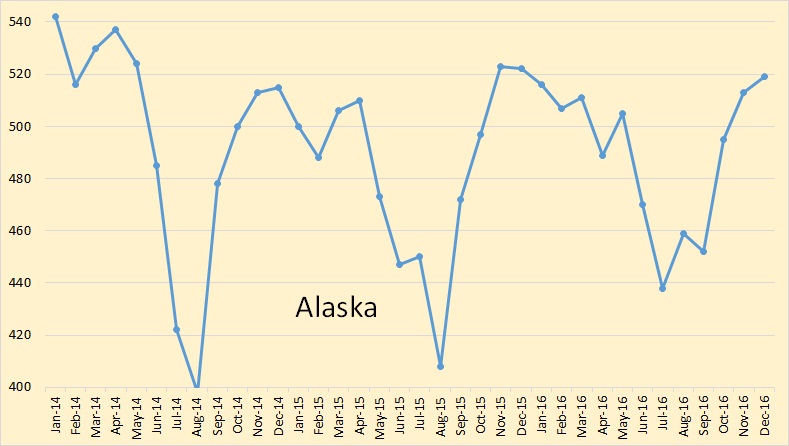

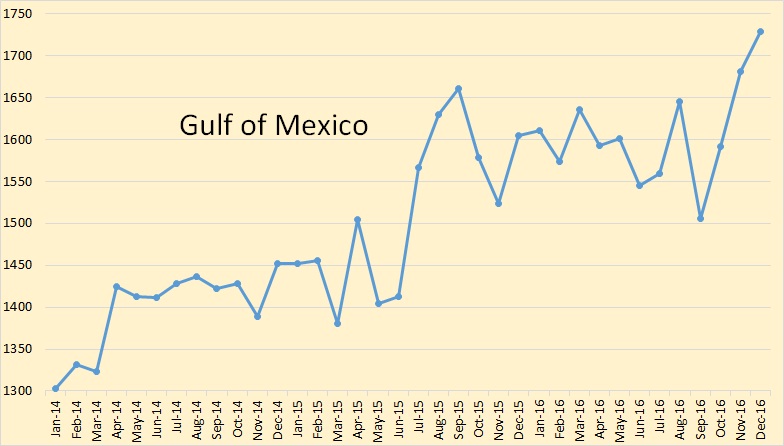

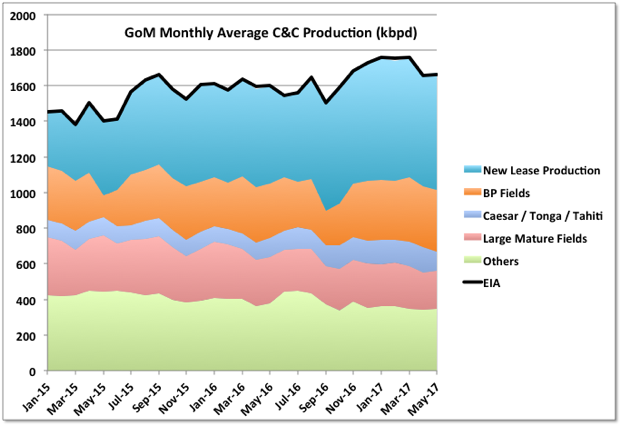

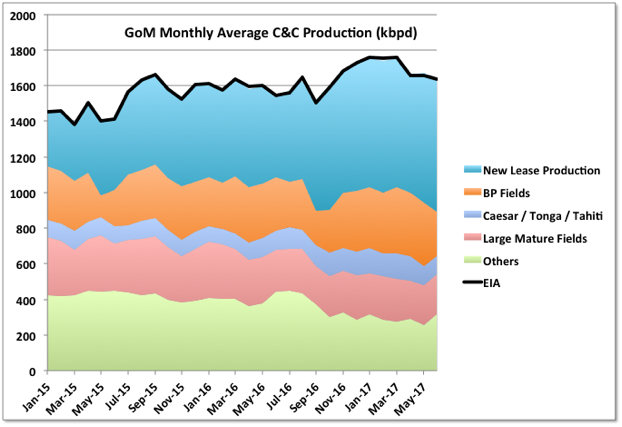

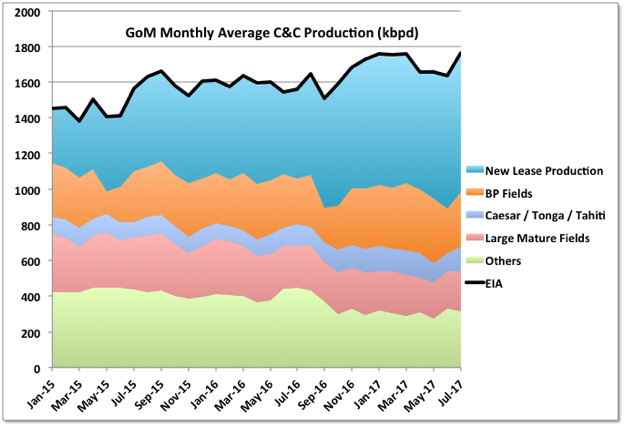

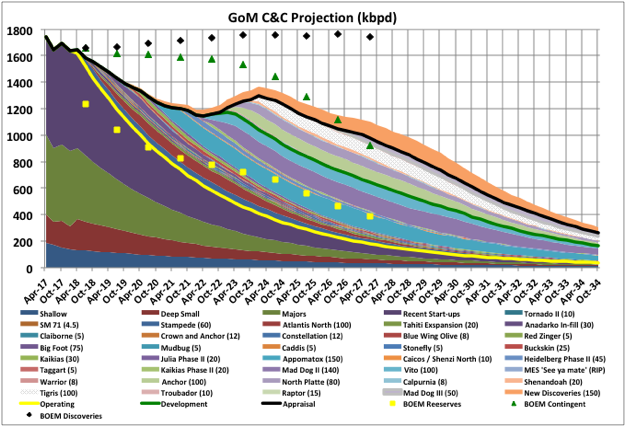

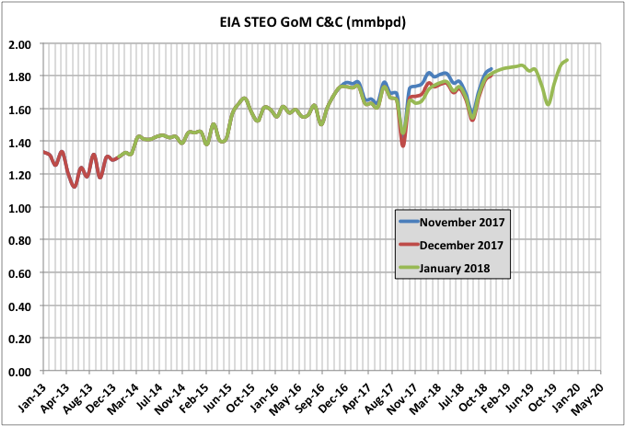

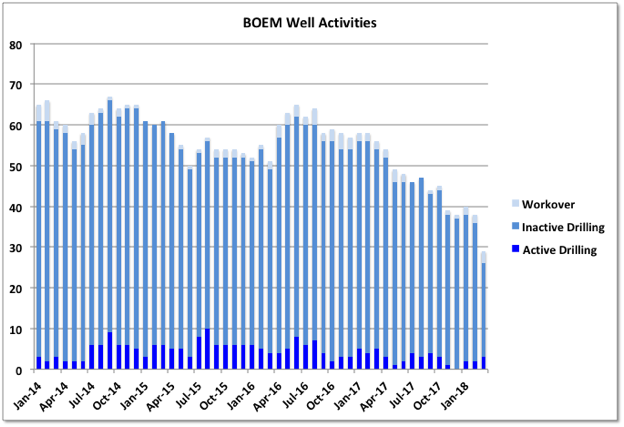

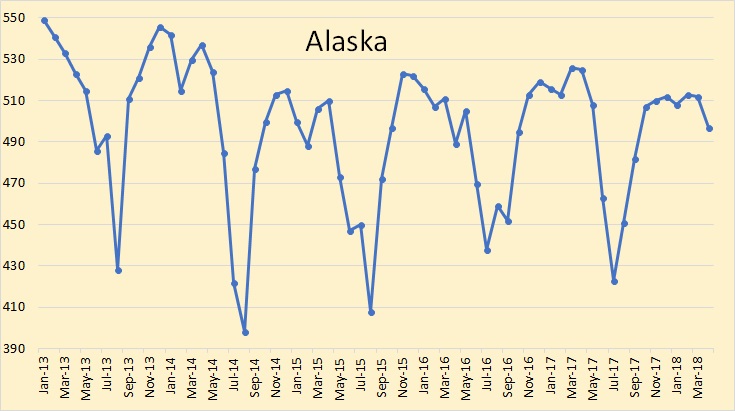

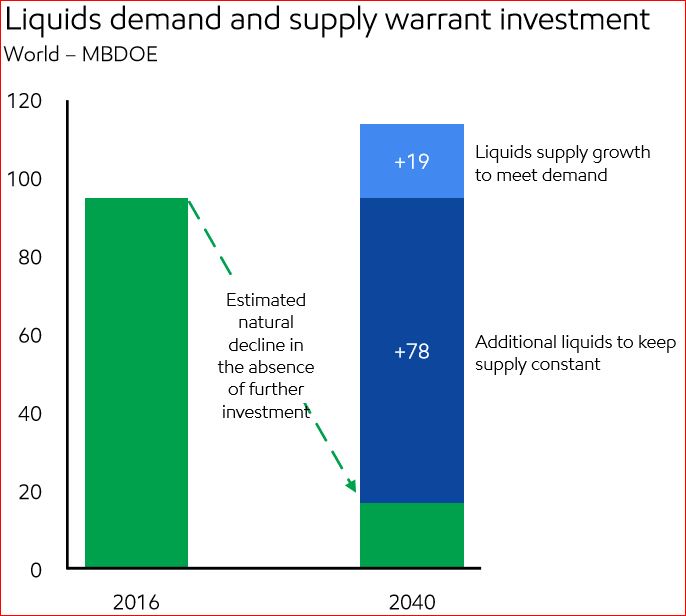

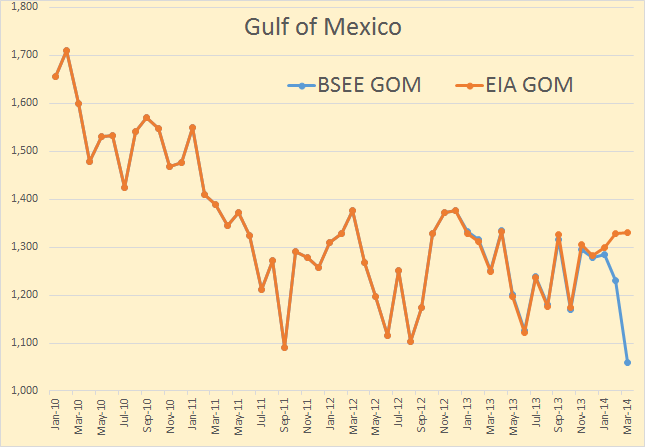

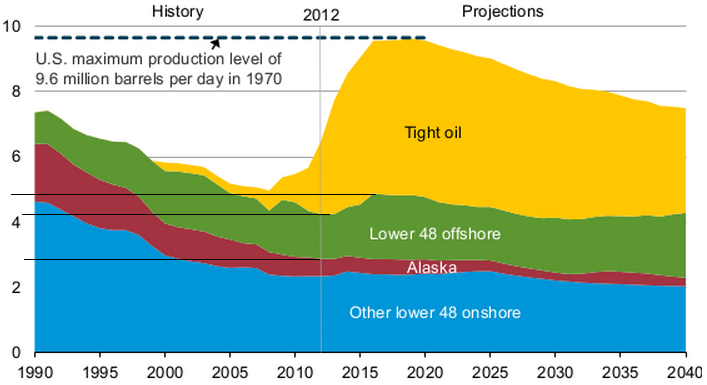

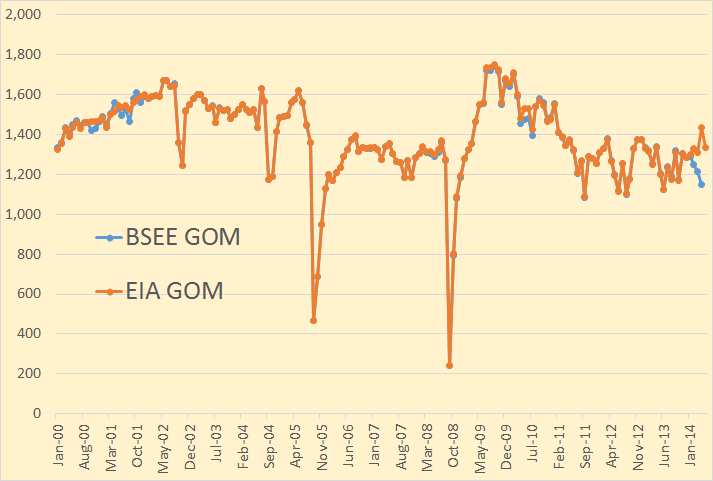

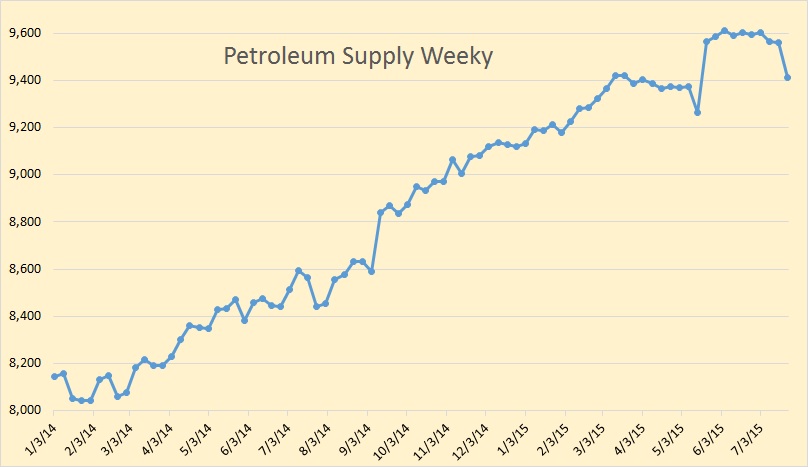

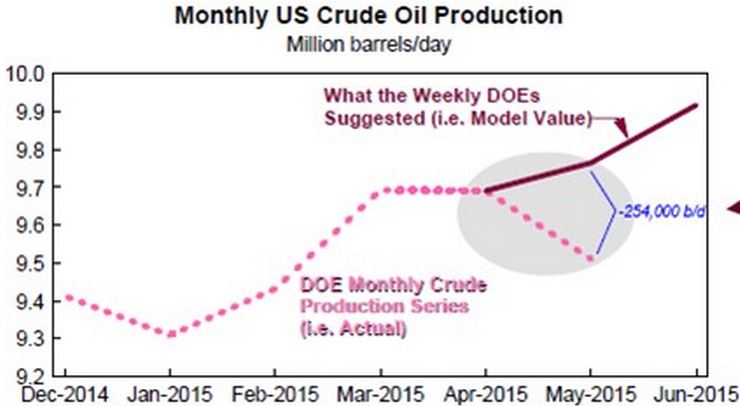

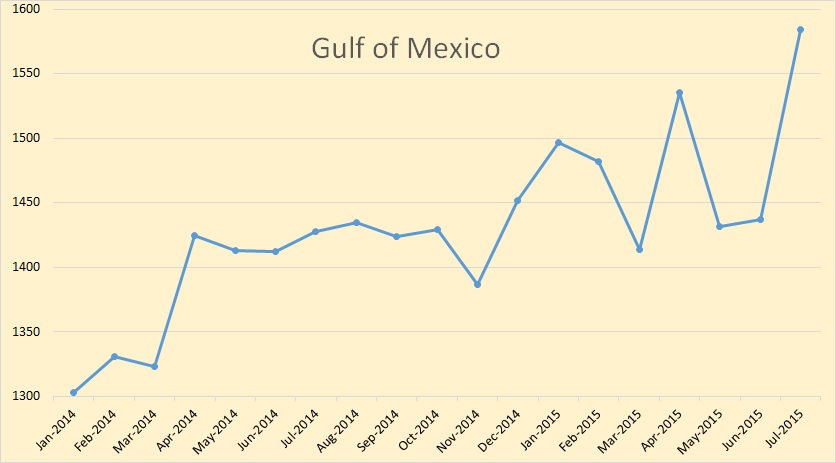

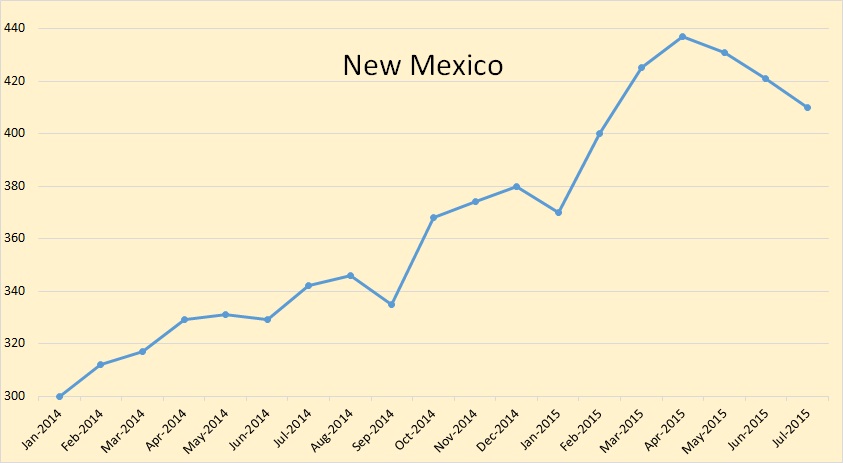

Before I discuss deepwater EUR, I will look at the EIA’s predictions about near term GOM oil production.

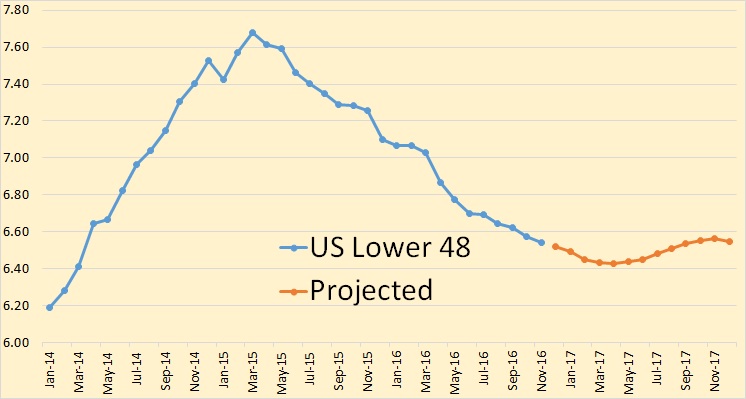

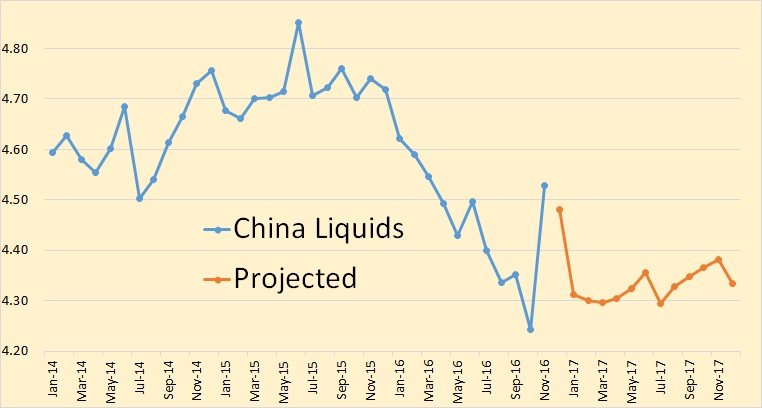

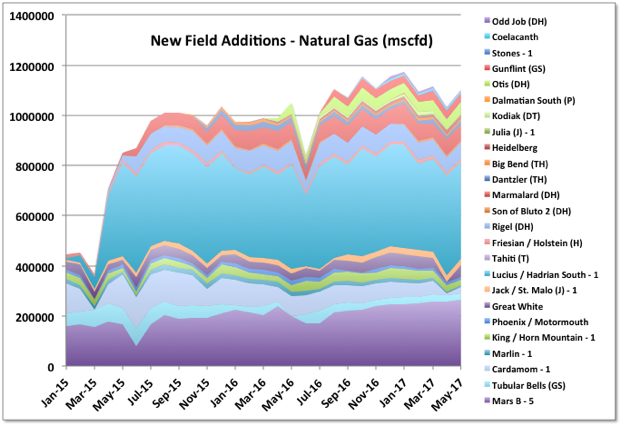

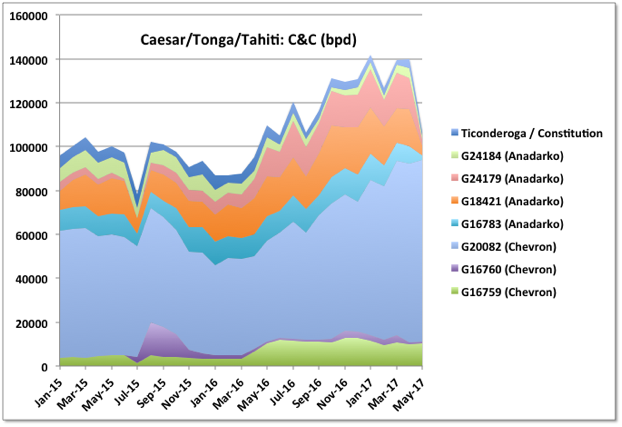

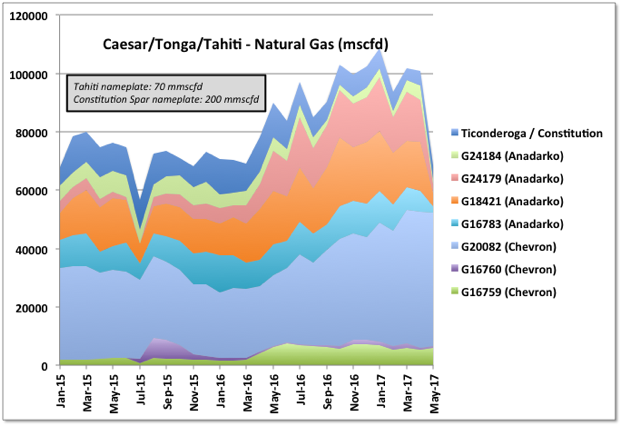

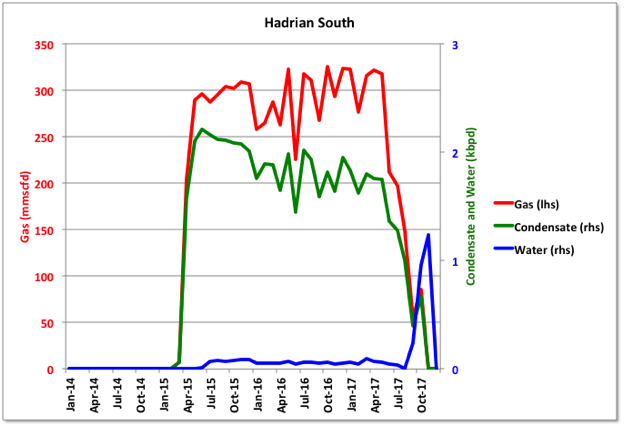

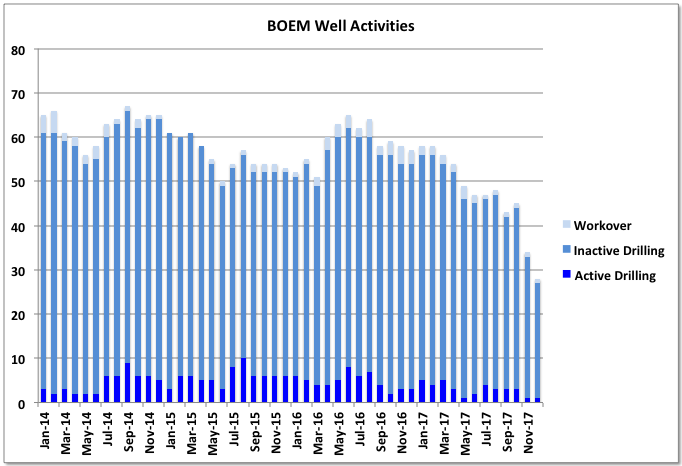

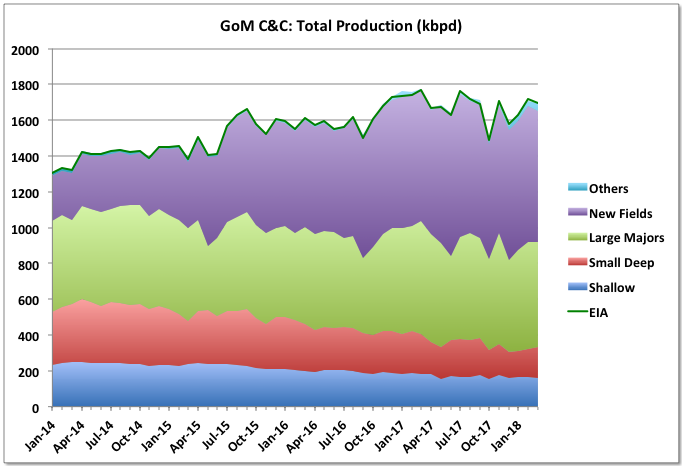

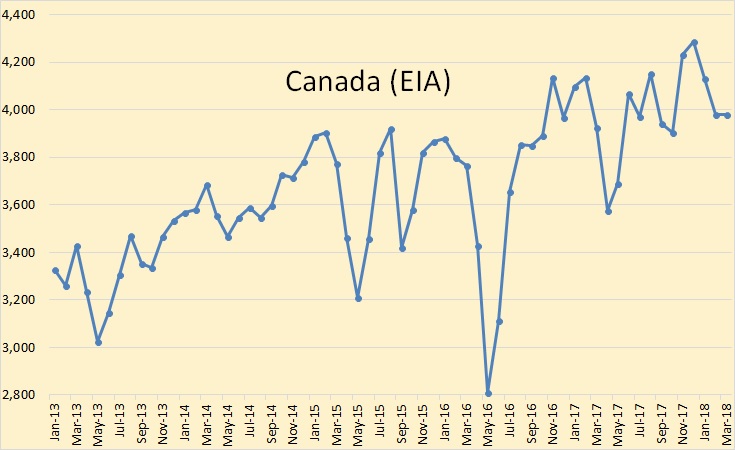

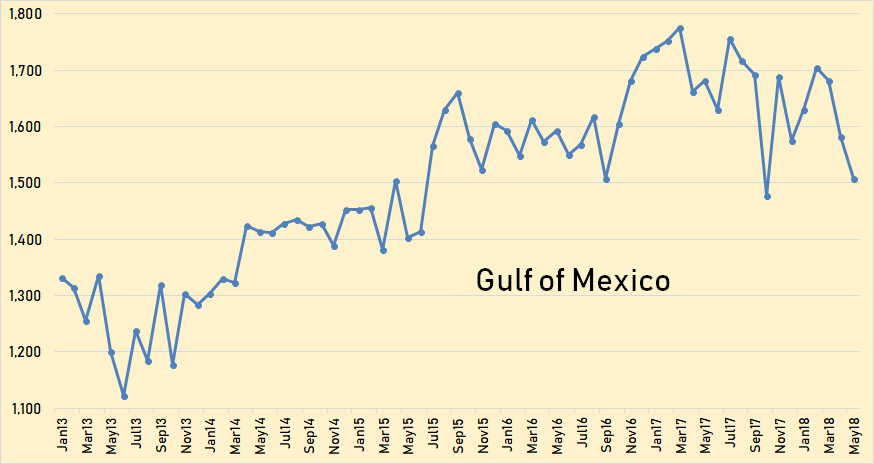

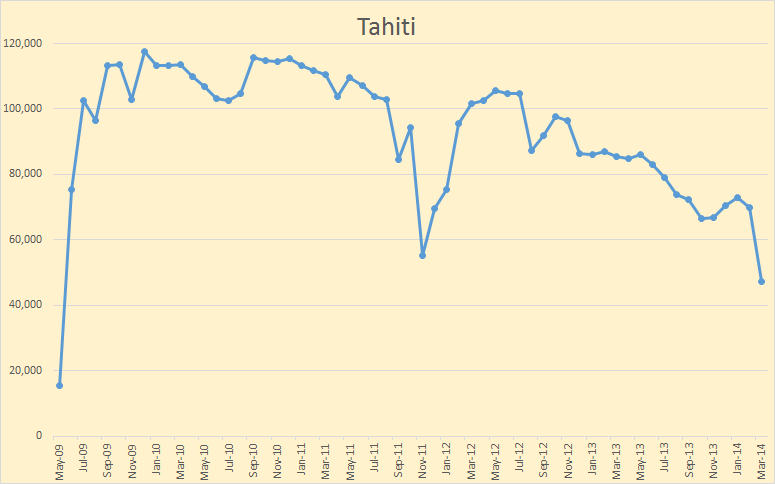

The chart below is monthly GOM production (average daily production per month) from early 2014 through 2017. Every data point left of, and including, the red circled point, is historical data. Every data point to the right is the EIA’s prediction through late 2017. The annual declines in the August through October time frame are their estimates of hurricane related downtime. From the middle of 2015 until May-2016, GOM production has hovered around 1.55-1.6 mmbopd. The EIA estimates that GOM production will start to exceed 1.8 mmbopd in November, 2016, and continue a gradual rise to over 1.9 mmbopd by late 2017.

These seem to me to be rather optimistic estimates. I don’t think production will get to levels over 1.8 mmbopd. 2016-2017 project start-ups that could contribute over 50 kbopd include Heidelberg (in SEGC on play map) and Stones (outer Wilcox). All others will probably contribute less than that. (Remember this is shelf plus deepwater production. Assume about 200 kbopd of the total production is from the shelf, and the remainder is from deepwater.)

I do believe industry will be able to maintain production levels over 1.5 mmbopd beyond 2017 with Stampede and Big Foot (both in SEGC) coming on in 2018. Both of these fields should be able to maintain production levels over 50 kbopd for at least a few years.

![SouthLageo/]()

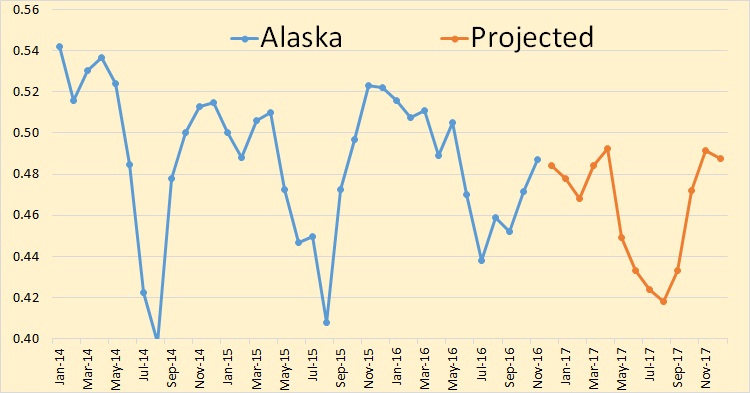

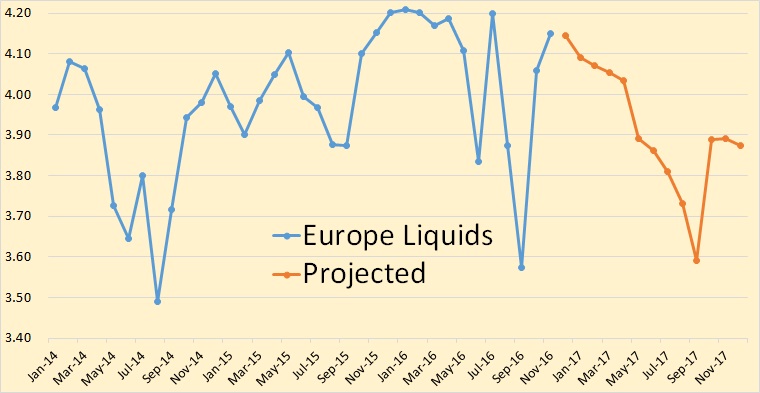

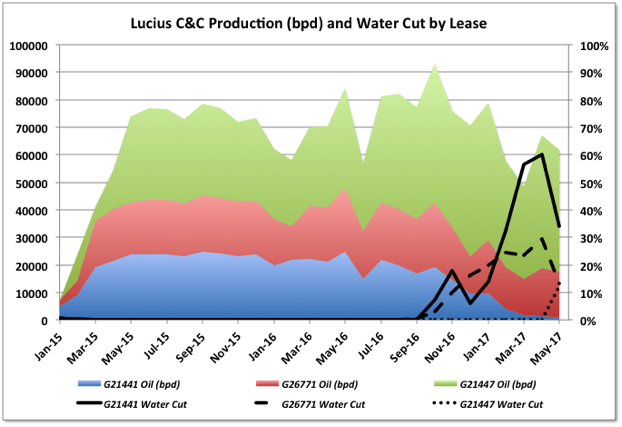

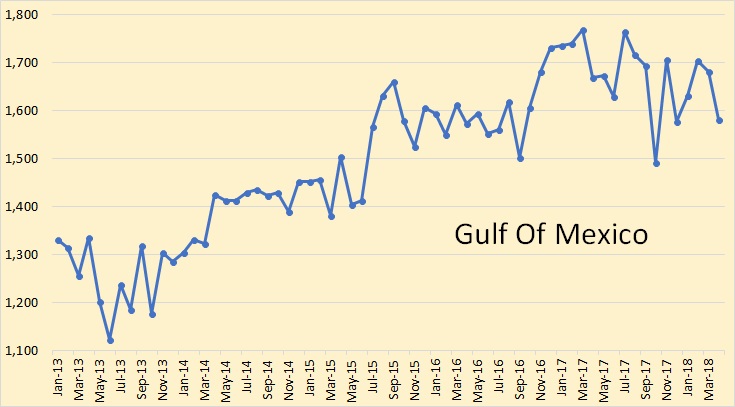

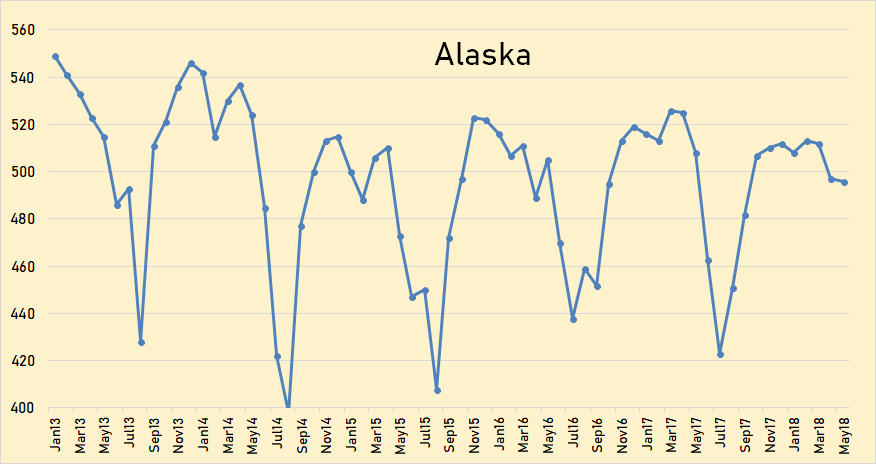

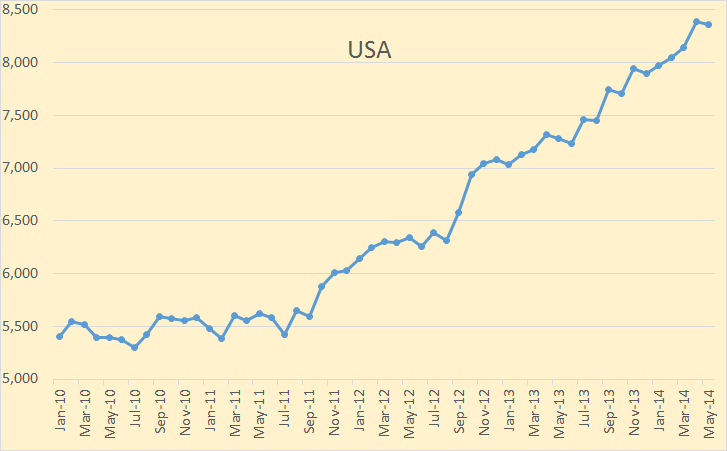

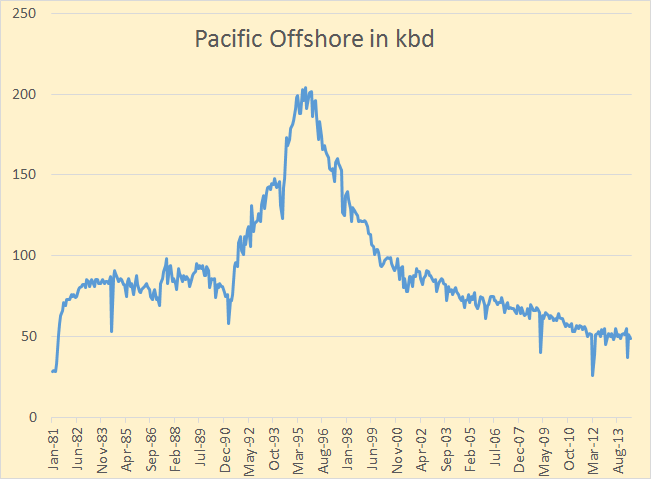

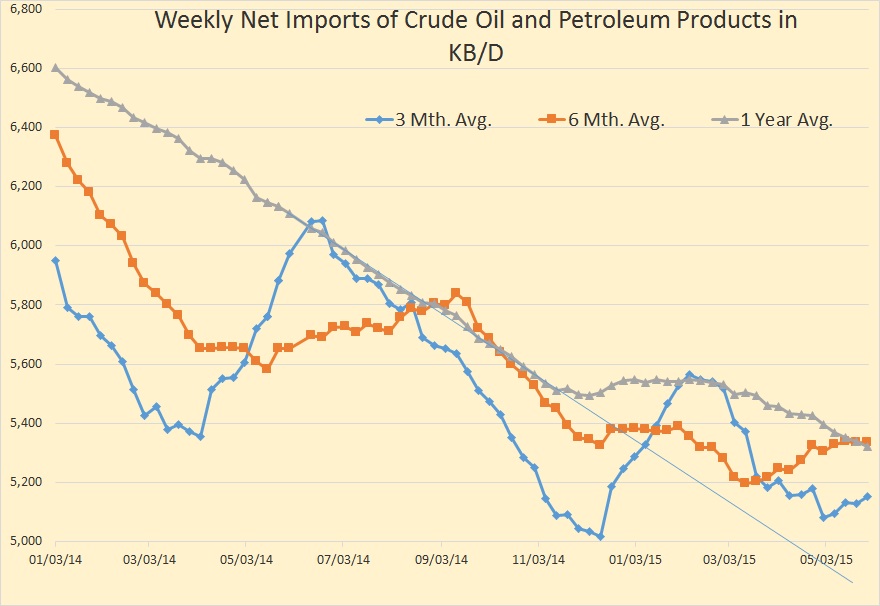

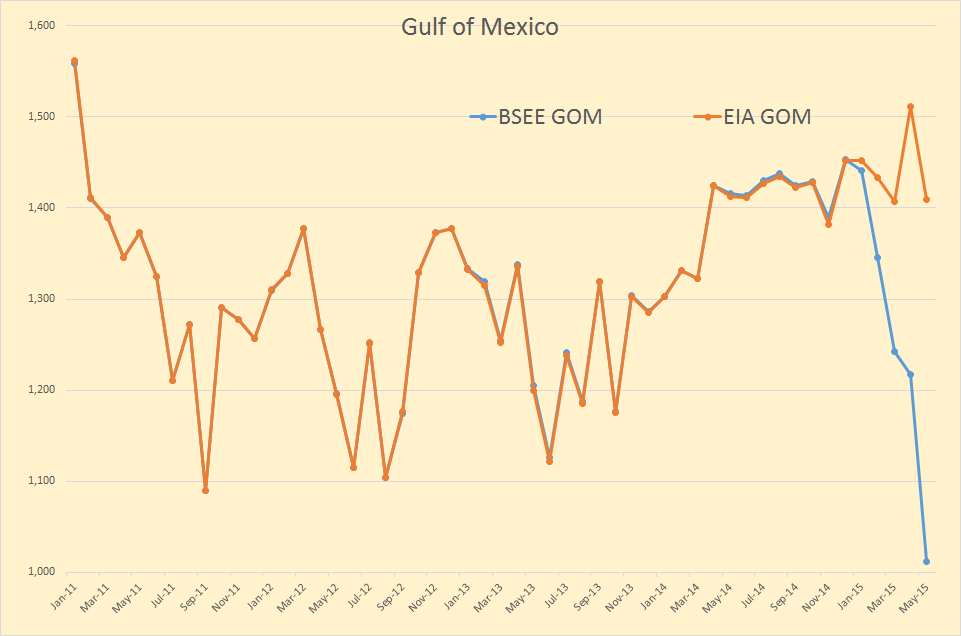

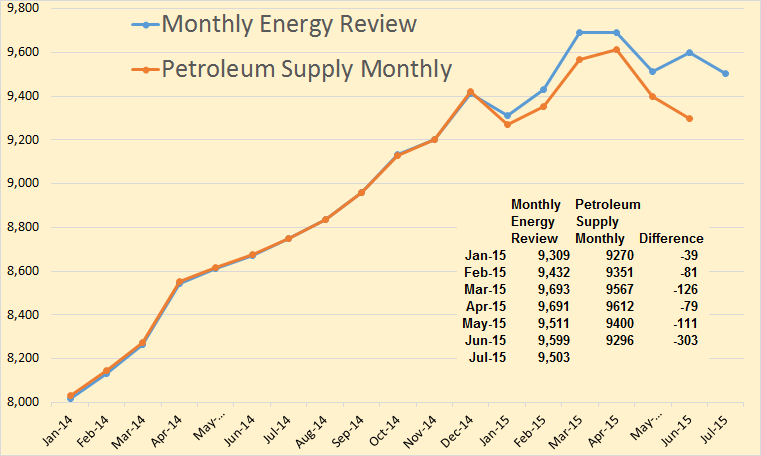

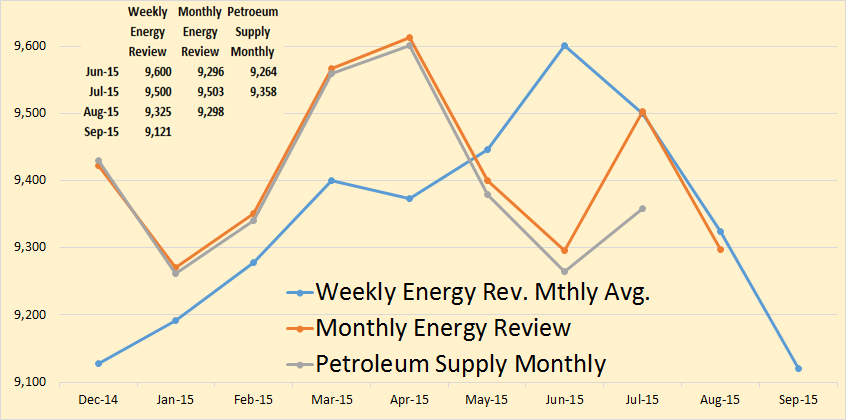

Below is Jean Laherrere’s recent HL estimate for deepwater EUR. He gives an EUR of 10 Bbo. His combined shelf and deepwater total is 24 Bbo.

In my opinion, he is underestimating the EUR from deepwater. The 3 spikes in the HL curve tie to the 3 spikes in production discussed earlier – the first spike, at about 1 Bbo, is from the early production from the basin plays, the 2nd spike, at 4-5 Bbo, is from the production spike between 2008 and 2009 from the Miocene subsalt, and the 3rd spike is the current peak in production due to existing field redevelopments and initial production from the Wilcox trend.

I believe Jean is underestimating the significance of the third spike in the way he draws the trend line through the data. It is too early to use HL to predict the EUR from the deepwater. (Jean suggests this in his paper). One has to at least wait until the 3rd spike starts to level off, or decline. When that portion of the curve levels off, or starts to decline, one would predict an EUR significantly higher than 10 Bbo.

While I am by no means an expert on the use of the Hubbert Linearization graphing technique to estimate EUR, I assume it works best in a basin where the biggest discoveries are made rather early, and smaller discoveries follow. And it also works best in basins where, if new plays are found, they are relatively small. That is certainly not the case with the deepwater Gulf of Mexico. (It is the case with the GOM shelf, and that is why HL works fairly well to predict ultimate EUR. That is, the biggest shelf fields were discovered early, and smaller discoveries followed).

![SouthLageo/]()

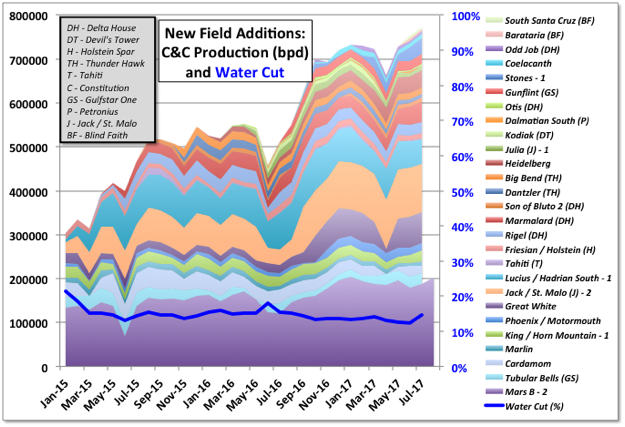

If one were only to look at existing fields on production, prior to the 3rd spike in production, I think the 10 Bbo EUR is reasonable, but if one includes the projects that are contributing to the third spike, plus the significant queue of projects that have either just come online, or should come on line between now and 2022 or so, I can see the EUR increasing to 13-16 Gb.

The projects contributing to the 3rd spike, as I mentioned above, include redevelopments of a number of older fields, plus Great White, the first Wilcox producing field.

Many of the projects that have either just come online, or should come online between now and 2022 or so include (including reference to trend map above):

Heidelberg, Big Foot, Stampede, and Mad Dog 2 – from Southeast Green Canyon,

Julia and Stones – from the Outer Wilcox trend,

Appomattox and offsets – from the Norphlet,

Power Nap, Vito and Kaikias from the Mars-Ursa basin

and Tornado, Kodiak and Gunflint – from the basin play trends. (Kodiak is technically not a basin play field, but a subsalt field in Mississippi Canyon).

Then if you include the list of Wilcox discoveries that have been made, and probably will come online in the early to mid-2020s, including:

the Tigress complex (Guadalupe, Tiber and Gibson), Shenandoah, North Platte, Anchor from the Inner Wilcox trend, and

Leon, Sicily and Kaskida, from the Outer Wilcox trend, one can probably add another 2-4 Gb of ultimate recovery.

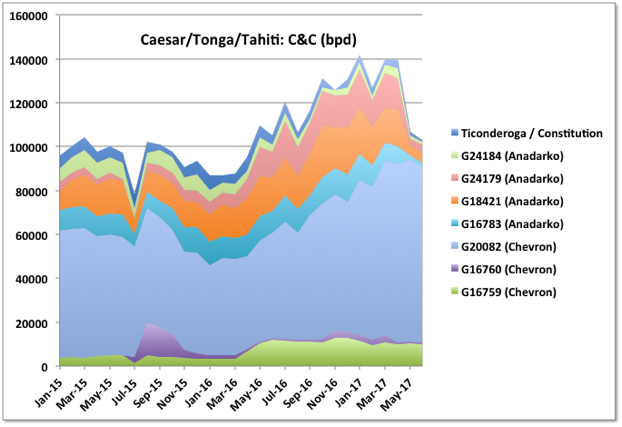

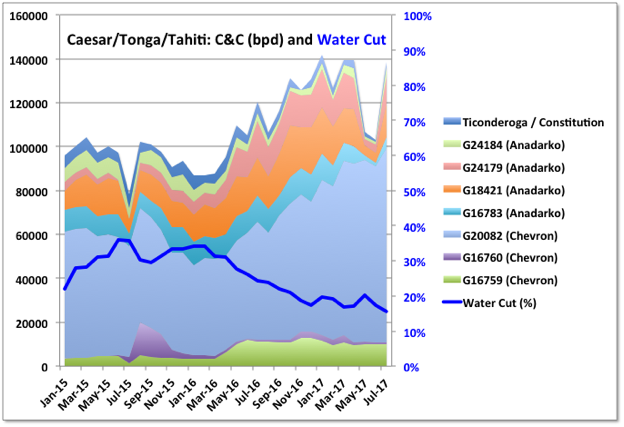

In the lists above, most of the projects that are highlighted bold will have a producing platform. Other projects will probably be sub-sea tiebacks to other producing platforms. In general, the projects with a producing platform need to be expected to produce at least 150 mmbo to justify the investment – although this number could be debated. The reserves needed to justify a tieback can range widely from as little as 15-20 mmbo for a single well to over 100 mmbo for a multi-well development. The currently producing Caesar-Tonga field in Southeast Green Canyon is a good example of a multi-well subsea tieback field that should easily produce over 100 mmbo.

Next we will look at data recently provided by BOEM. What BOEM provides is actually an endowment estimate, though, I will attempt to determine an EUR estimate from their numbers.

BOEM recently released their “Assessment of Undiscovered Oil and Gas Resources of the Nation’s Outer Continental Shelf, 2016”.

http://www.boem.gov/National-Assessment-2016/

This study is effective as of January 1, 2014.

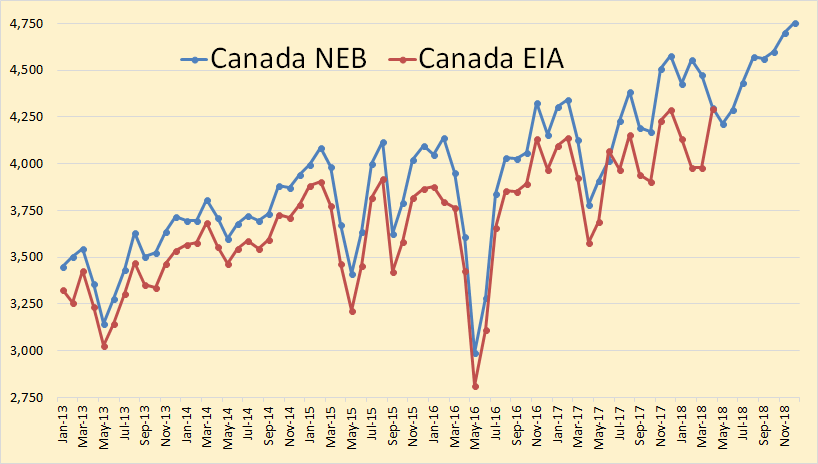

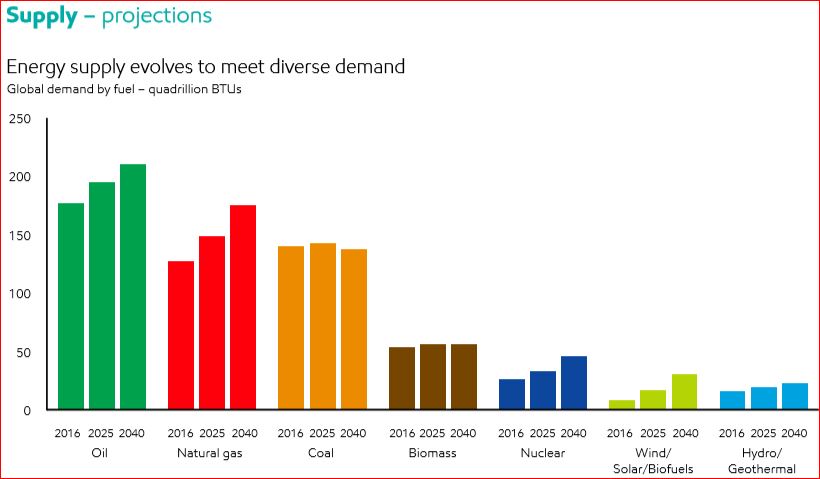

Their total endowment for the Gulf of Mexico is 83 Bbo. This is made up of Cum. Production = 19 Bbo, Remaining Reserves = 4 Bbo, Contingent Resources = 3 Bbo, Reserves Appreciation = 9 Bbo, and Undiscovered Technically Recoverable Resources (UTRR) = 48 Bbo.

The sum of cum production + remaining reserves + reserve appreciation = 32 Bbo. This could be thought of as an EUR estimate from existing fields and be compared to Jean Laherrere’s shelf + deepwater EUR of 24 Bbo. The difference is, I believe, mainly due to BOEM’s 9 Bbo estimate of reserves appreciation – otherwise the totals are 24 v. 23 Bbo. Reserves appreciation is a bottom’s up (field by field) calculation performed by BOEM that results in an “increase in reserve estimates from extension, revision, improved recovery or new reservoirs”.

The remaining BOEM estimate includes 51 Bbo of resources – 3 Bbo coming from existing fields and 48 Bbo from undiscovered fields (BOEM’s UTRR). Their UTRR estimate assumes no economic constraints. When they apply economic constraints, this number varies from 31 Bbo at $30 oil up to 45 Bbo at $160 oil, and the term becomes Undiscovered Economically Recoverable Resources (UERR).

This estimate, whether one uses 31 Bbo, 45 Bbo or 48 Bbo, is quite large, but, keep in mind this is an unrisked resource estimate. In previous comments in this forum, myself and others have commented on these numbers from BOEM’s 2011 report suggesting they are unreasonably high. I was mistaken in assuming these numbers where BOEM’s estimate of EUR coming from undiscovered fields. In actuality, these are resource numbers, not reserves, and therefore they should be risked. Should one risk these numbers at 10%, 25%, 40%?

For a number of years, when what I called the “great unveiling” was occurring, and many of the subsalt basins were being illuminated by new seismic, industry’s discovery rates were probably 30-50%. But, I believe future discovery rates will be lower as more challenging areas are explored. I can see future discovery rates in the 20-30% range.

If one assumes a 25% future discovery rate and applies it to a UERR of 40 Bbo, one gets an EUR from yet to be discovered fields of 10 Bbo (and let’s assume all that comes from deepwater).

So, in total, I estimate BOEM’s EUR total to be 32 Bbo (their cumulative-to-date plus reserves) + 10 Bbo (from new fields) or 42 Bbo. If one assumes a shelf EUR of 15 Bbo, that leave a deepwater EUR of 27 Bbo.

(Please note – BOEM has not provided an EUR estimate for the GOM. I have played some games with their resources estimates, and added these numbers to their cumulative production and reserves estimates to give one view of how BOEM’s numbers could be interpreted to provide an EUR estimate.)

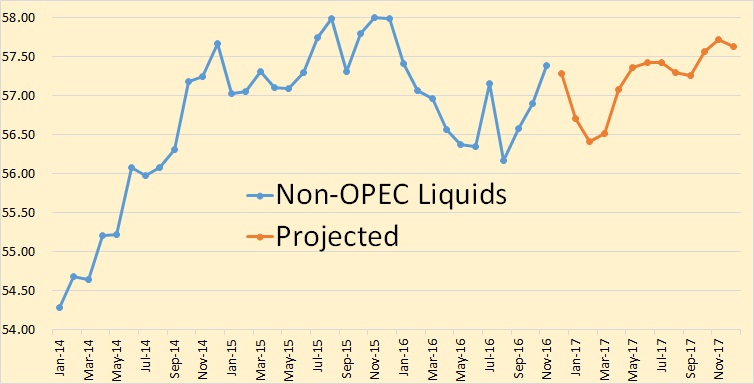

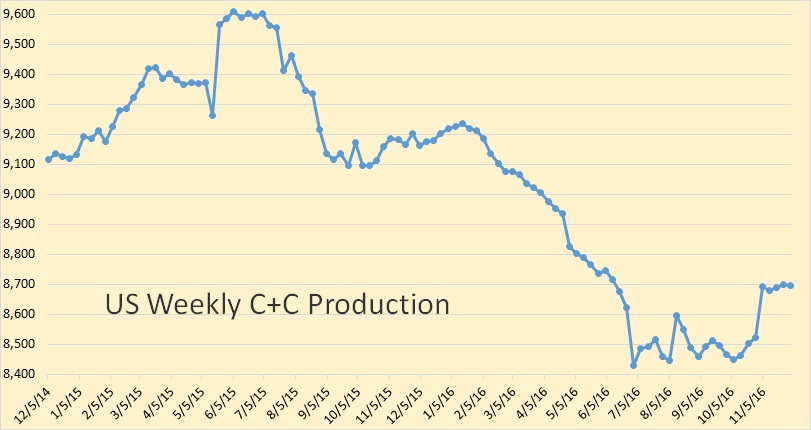

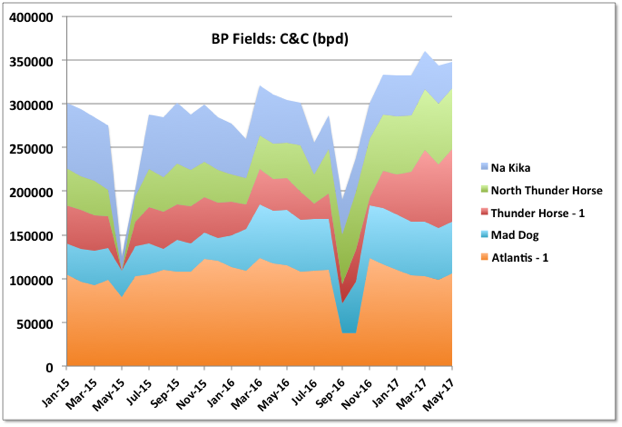

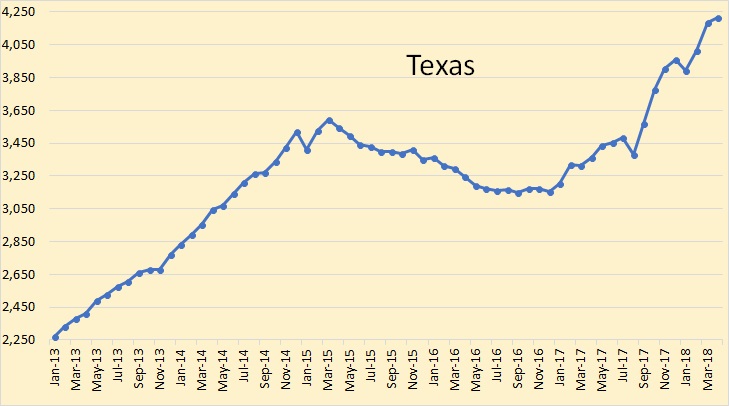

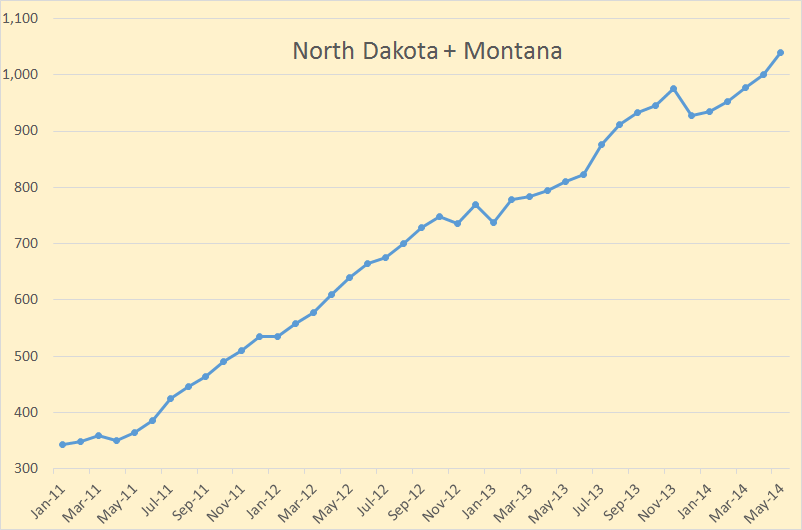

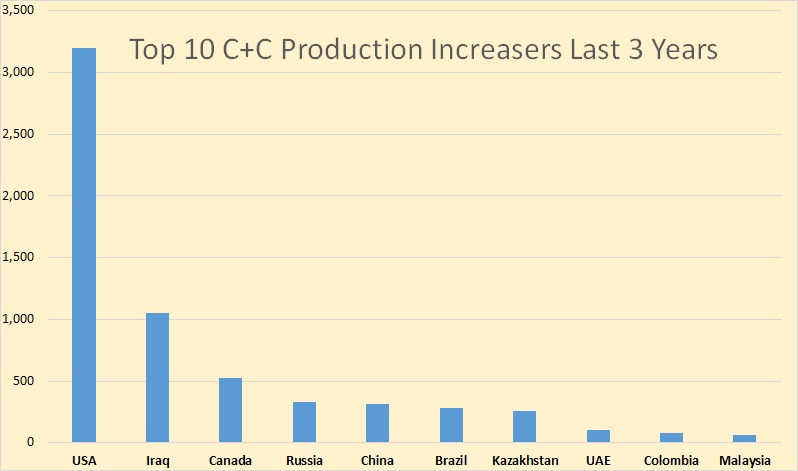

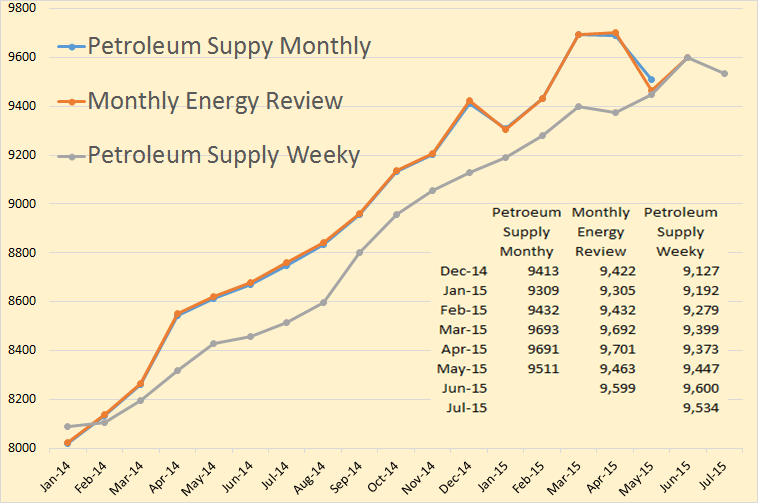

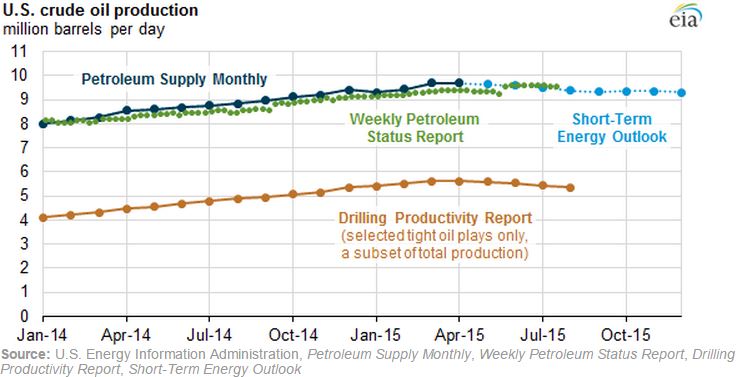

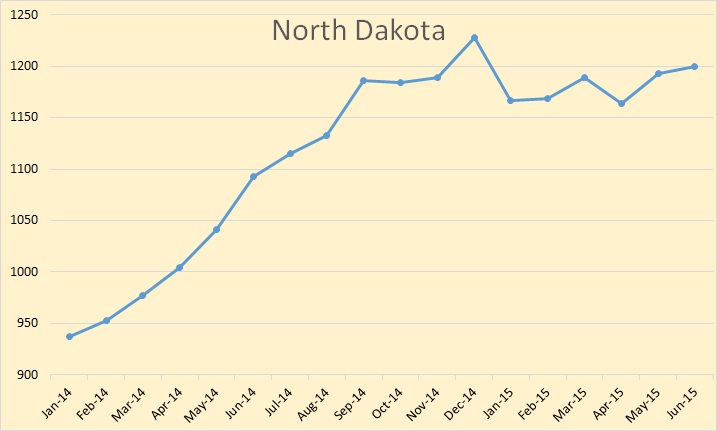

Next I provide my estimate of deepwater GOM EUR. I have previously discussed many of the inputs to my estimate, so I have summarized my estimate in the table below. I provide mine probabilistically with low-mid-high ranges.

![SouthLageo/]()

* some of what BOEM calls “contingent resources” falls into this category

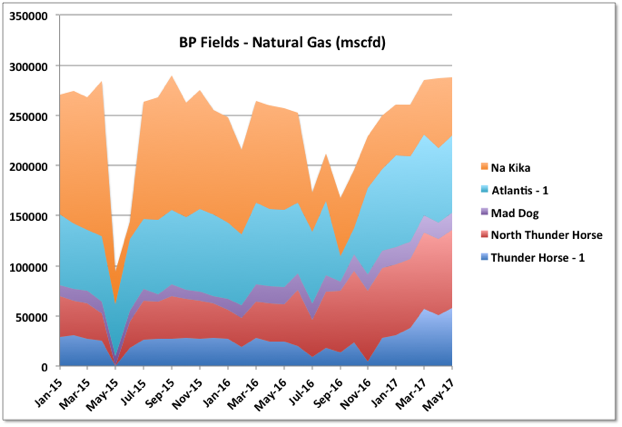

Below is a compilation of the 3 EUR estimates, including both shelf and deepwater.

![SouthLageo/]()

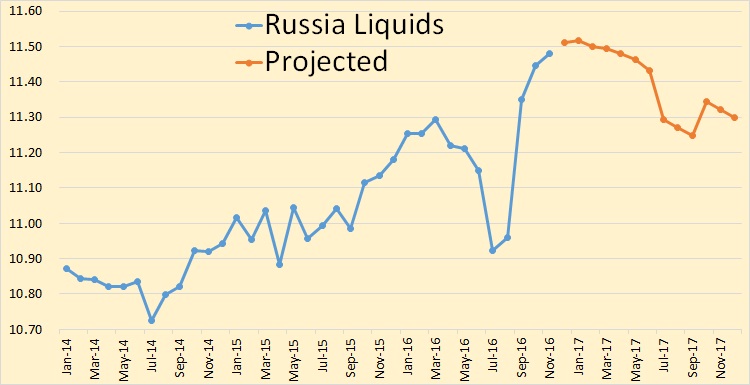

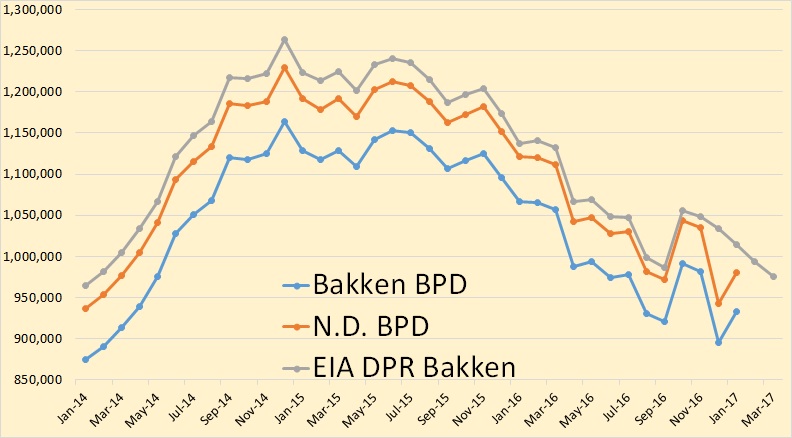

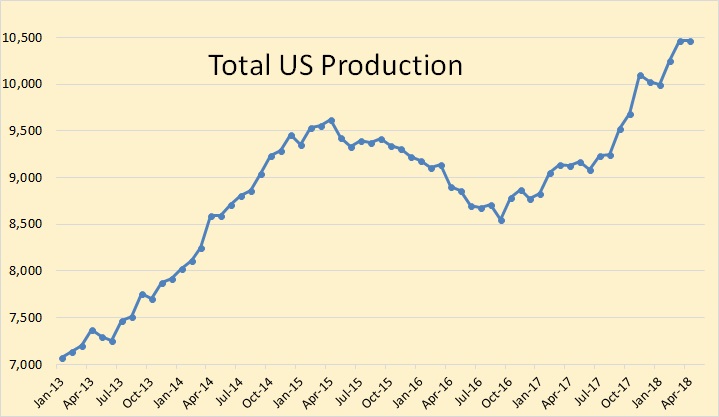

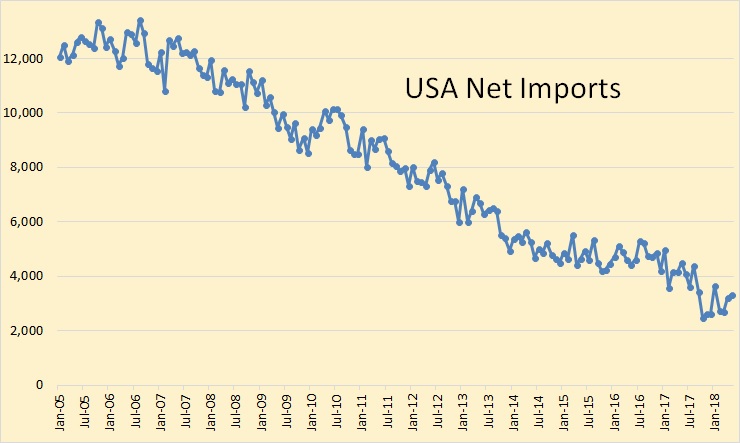

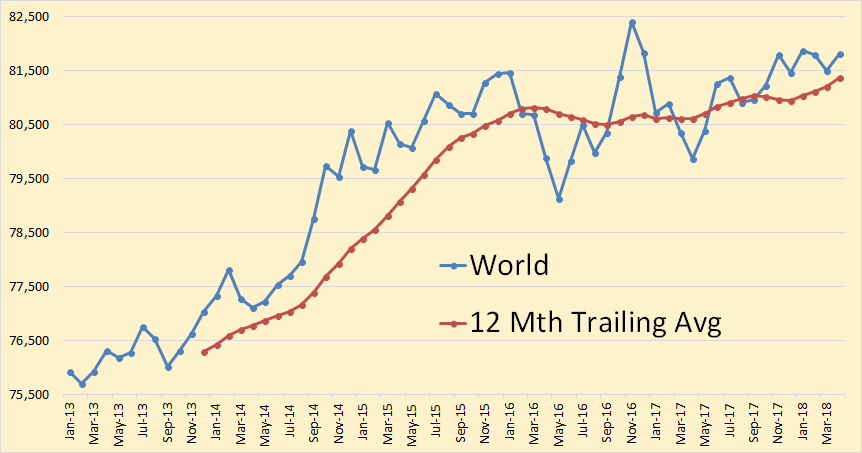

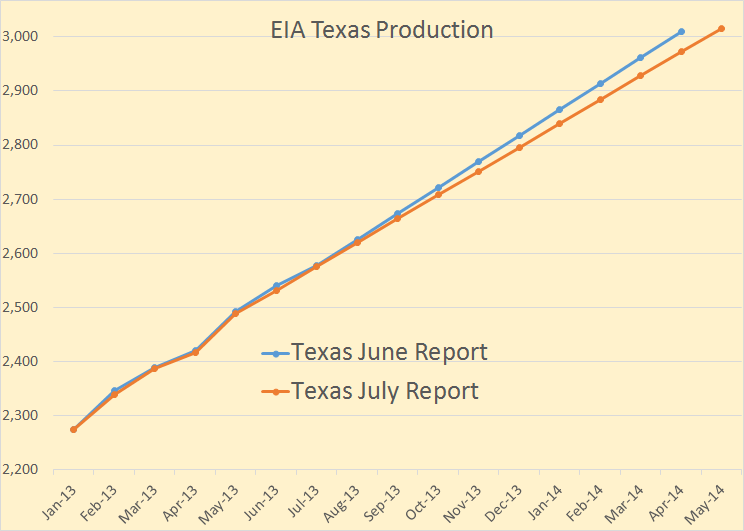

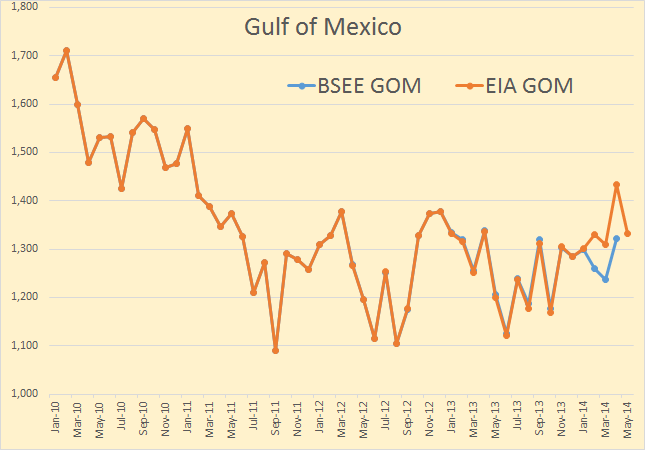

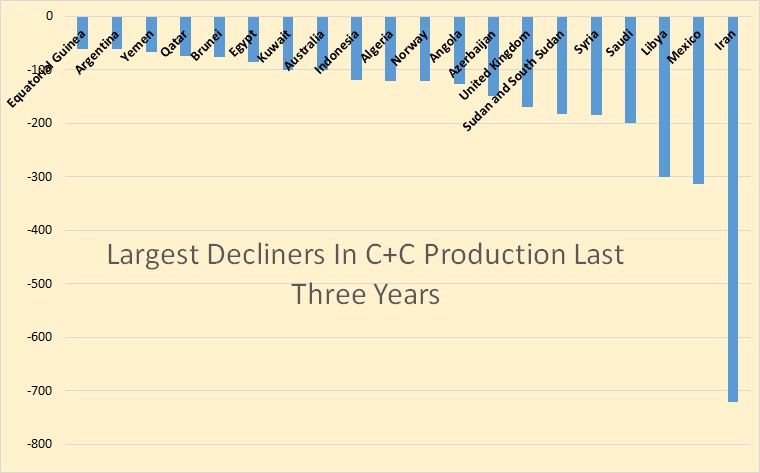

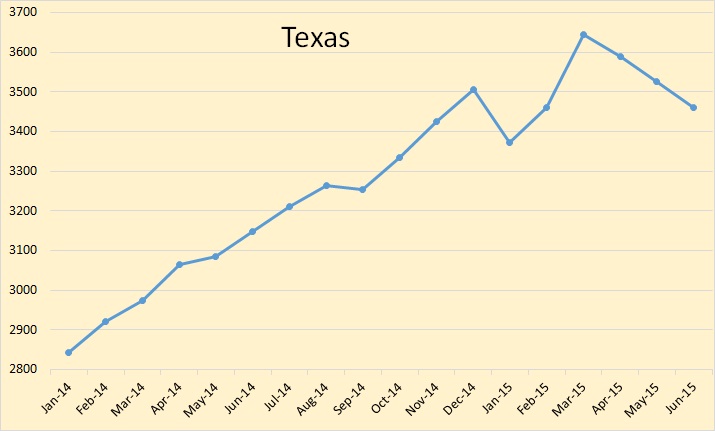

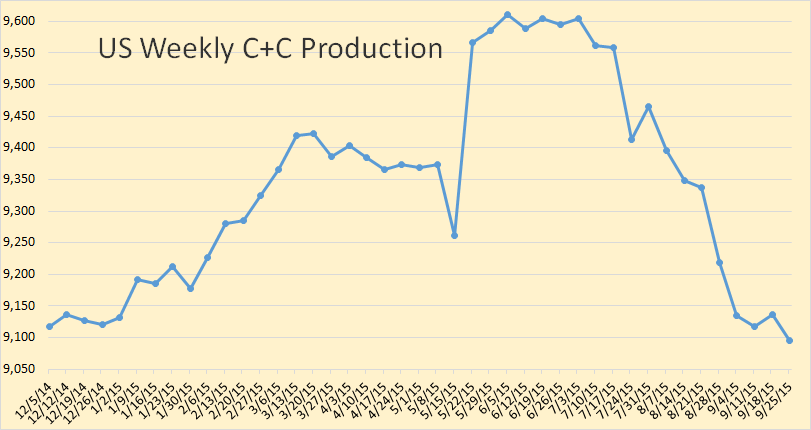

I finish up with a projection of future GOM production using my EUR estimates ranging from 30-37-47 Bbo. Keep in mind that this includes both deepwater and shelf, but shelf production is starting around 200 kbopd or so in 2016 and declining in future years. I never show total production over 1.7 mmbopd, and show it going out to 2059 in the low case, to 2073 in the mid case, and to 2094 in the high case.

The downside case shows a peak in 2020, and then a gradual decline, dropping below 1 mmbopd in the late 2020s, and below 500 kbopd in the late 2030s. The midcase shows a peak of 1.6 mmbopd through the early 2020s, followed by a plateau of 1.55 mmbopd in the late 2020s, then declining below 1 mmbopd in the late 2030s. The high case predicts a peak through the 2020s of 1.65 mmbopd, followed by series of plateaus ranging from 1.6 mmbopd down to1.5 mmbopd through the mid-2030s, followed by a gradual decline to below 1 mmbopd in the mid-2050s.

![SouthLageo/]()

Do I really think GOM oil production could continue to 2094, as shown in the upside projection? Remember, this is a Business As Usual projection, assuming fossil fuels will continue to be needed and be “affordable”.

If you assume that there is no way production could continue past 2060 – then the downside case still produces 30 Bbo, the midcase EUR is 37, and the upside case has already produced 42 Bbo of its ultimate EUR of 47 Bbo.

The following table shows how the different EUR projections break down by decade through 2090.

![SouthLageo/]()

Note that I am still a working stiff, and will respond to comments as time allows.

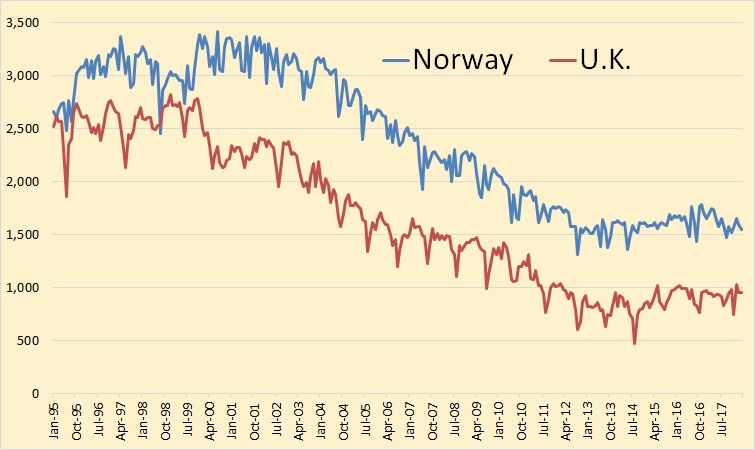

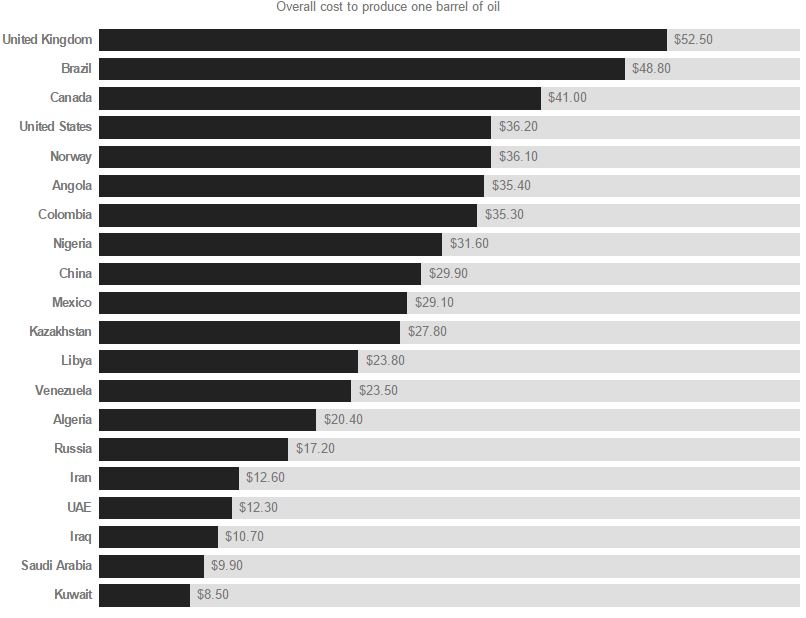

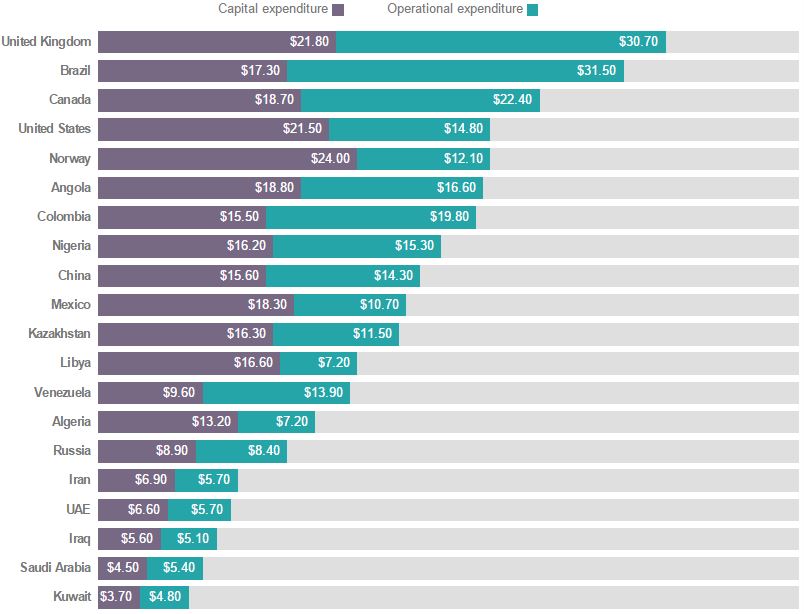

Here is the breakdown between capital expenditures and operational expenditures. Why would the United Kingdom’s operational expenditures be two and one half times those of Norway? After all, they are both drilling basically the same oil field.

Here is the breakdown between capital expenditures and operational expenditures. Why would the United Kingdom’s operational expenditures be two and one half times those of Norway? After all, they are both drilling basically the same oil field.